The National Minimum Wage (NMW) for each “ordinary hour worked” has been increased from 1 March 2024 by 8.5% from R25-42 to R27-58.

Domestic Workers: Assuming a work month of 21 days x 8 hours per day, R27-58 per hour equates to R220-64 per day or R4,633-44 per month. The Living Wage calculator will help you check whether or not you are actually paying your domestic worker enough to cover a household’s “minimal need” (adjust the “Assumptions” in the calculator to ensure that the figures used are up to date).

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

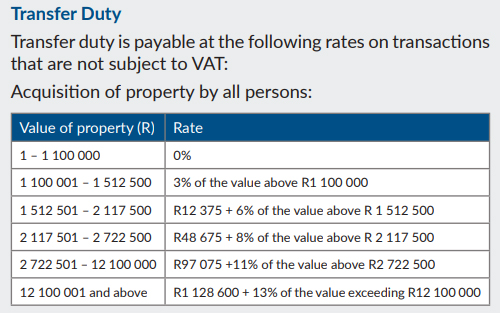

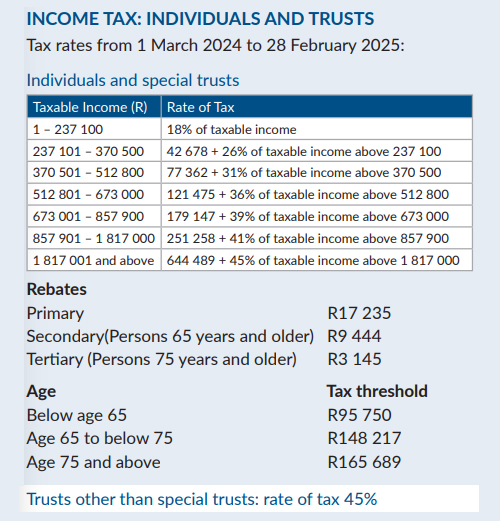

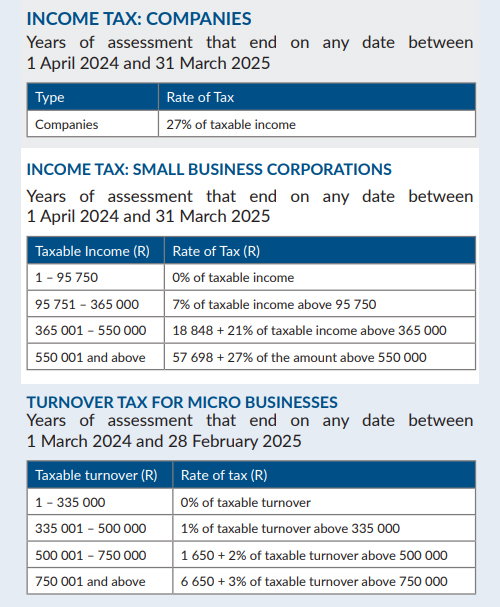

The unchanged transfer duty and tax tables, with a note on fiscal drag

Unchanged from last year, so taxpayers can breathe a sigh of relief that rates have not been increased as many forecasters had feared.

But the other side of the coin of course is that there is no inflation adjustment to the rates this year, which means that “fiscal drag” will leave you paying more tax if your inflation-linked increase pushes you into a higher tax bracket. Effectively, the buying power of your net income will fall. Plus if your property has increased in value into a higher threshold, your buyer will pay more transfer duty.

Source: SARS

Source: SARS

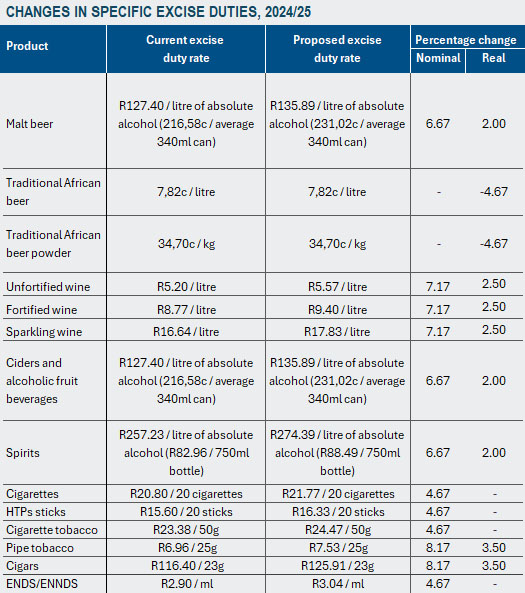

“Sin taxes” up – the details

Source: National Treasury

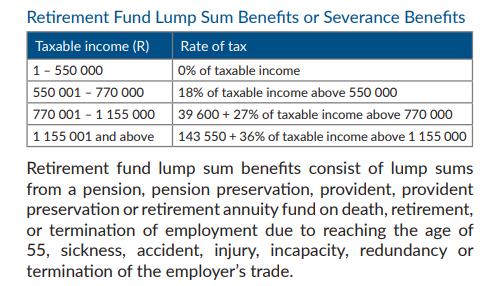

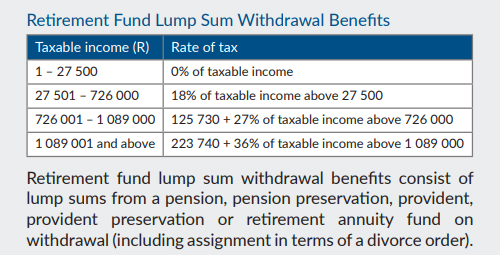

Retirement funding and the “two-pot” reform proposal

Source: SARS

Source: SARS

The proposed “two-pot” retirement reform: Per National Treasury: “Early access to retirement funds – “The two-pot retirement system will allow retirement fund members to make withdrawals from their retirement funds while they are still active members, so members need not resign to access part of their retirement benefits. … This reform is proposed to come into effect on 1 September 2024. The National Treasury aims to finalise the legislative process rapidly in the next few months to ensure that industry and regulators can prepare for implementation. Policy research and engagement continues on the outstanding auto-enrolment, mandatory enrolment and consolidation retirement reforms.”

The proposals and their tax implications are complex and subject to change, but currently provide for a one-off withdrawal of up to R30,000 on implementation, and thereafter annual “savings withdrawal benefits”.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“No person shall without the prior approval in writing of the local authority in question, erect any building in respect of which plans and specifications are to be drawn and submitted in terms of this Act.” (National Building Regulations and Building Standards Act)

Here’s a nightmare scenario for a buyer – you move into your new dream home, and only then find out that your lovely little office/spare bedroom extension has no approved building plans. The municipality says the seller’s building works were unapproved and unlawful – you must demolish the extension.

How can you guard against that happening to you?

Planning permission is legally required before building

Firstly, local authority planning permission is a legal requirement before any building works, renovations or extensions can take place. You will need to check with your local municipality what its particular requirements are, and what “minor” works are exempt from this requirement in your area.

Without municipal permission, you have an unlawful structure on your hands – a recipe for disaster.

The problem for a buyer is that, once the transfer is through and you are the registered owner, it is to you as buyer that the municipality will look to obtain any outstanding building authorities and plans, to pay any penalties for non-compliance, and possibly even to demolish the unlawful structures.

The seller isn’t obliged to supply proof (and plans) to you, unless…

Your risk as buyer is that the seller is only obliged to supply proof of planning permission and approved plans to you if that is specifically required by the sale agreement. Ideally ask for plans before you even put your offer in, otherwise insist on a clear clause in the agreement requiring the seller to produce the plans before transfer. It’s the only way to avoid the risk of having to rectify unlawful structures.

Make sure it is clear that the seller (not you) must get and produce the plans

A 2023 High Court decision addressed a claim by buyers who had at the negotiation stage noticed newly erected buildings in respect of which they were advised that building plans were at the ‘approval stage’ with the municipality. Accordingly, the sale agreement provided that the sale was subject to approval of building plans by the municipality.

What the deed of sale did not specify was who had to get the plan approval – was it the buyer, or the seller?

The Court ultimately declared the seller responsible for obtaining the plans on the basis that by default only a landowner can apply for approval and plans, but that victory for the buyer came only after a hard-fought court battle – avoid all that delay, cost and dispute with an upfront clause clearly putting the obligation on the seller.

When you have the plans, check them against all structures

Plans in hand, check that all the buildings and structures actually on the property tie in with the municipal approvals and plans. It’s not uncommon to find plans are outdated or inaccurate. Sometimes regulations have changed, sometimes owners chance their luck or have just overlooked the need to keep plans updated as renovations and extensions take place. And whilst the municipality may accept “minor” deviations from plans, you should be sure of what is acceptable and what isn’t before you take transfer. First prize here of course is updated “as-built” plans showing the construction as it exists after completion – you’ll probably need them anyway if you do renovations down the line.

Sellers – why should you have the plans ready to offer them to the buyer?

The other side of the coin of course is that as a seller, even though you aren’t legally required to do so, it makes a lot of sense to have on hand copies of all building approvals and plans before you sell –

- As a sales tactic you can now reassure prospective buyers that all structures are lawfully constructed.

- You will avoid delay if the bank granting the buyer a mortgage bond decides it wants copies of plans as part of its approval process. That’s exactly what happened in the High Court case discussed above, delaying transfer substantially.

- You will also be reassuring yourself that all necessary approvals and plans were in fact obtained at the time of construction. If it turns out for example that you or a previous owner inadvertently dropped the ball in that regard, a disaffected buyer will try to pin all the blame on you. You might even be accused of fraudulently concealing a lack of plans – in which event the standard “voetstoots” (“as is”) clause won’t protect you. There’s no risk of any of that if you have the actual plans on hand from the start.

- In any event the “Mandatory Disclosure Form” that you must attach to the sale agreement specifically requires you to certify that the necessary consents, permissions and permits were obtained for any additions/improvements etc. Attaching the actual approvals and plans is the best way to cover you in the event of any dispute down the line.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Marriage is the chief cause of divorce” (Groucho Marx)

This Valentine’s Day, think about the legal aspects of your romantic relationship. They’re a lot less exciting than the traditional declarations of love backed up by chocolates and flowers, but they’re just as important in ensuring a strong, committed life partnership in which both of you is clear as to how your respective financial and legal responsibilities are defined.

A recent High Court decision once again puts a spotlight on the fact that “life partner” couples are at ongoing legal and financial risk unless they sign both cohabitation agreements and updated wills.

The problem – there’s no such thing as a “common law marriage”

Our law does not recognise the concept of a “common law marriage”. Either you are formally married, or you miss out on many of the legal protections available to married couples. The result – if you split, or when (not if) one of you dies, the less financially strong life partner could well be prejudiced, perhaps even left destitute after many decades of life together.

The solution – a cohabitation agreement with updated wills

Luckily these two documents give both of you quick and effective protection –

- A cohabitation agreement tailored to meet your particular circumstances and needs. It should at the minimum cover questions such as whose name assets and liabilities will be in, who will cover what expenses, how you will split your financial affairs if you part ways, your undertakings to each other regarding financial support and maintenance, parental rights and duties regarding children and so on.

- A will (“Last Will and Testament”). You could make two separate wills or one joint one but either way make sure to comply with all formalities to ensure validity and set out your respective wishes clearly and unambiguously. A vital (and all-too-often overlooked) aspect here is to diarise regular reviews of your will/s in case they need updating to take account of ongoing life and financial changes.

Let’s turn now to a “second prize” alternative – proving a “universal partnership”.

What is a “universal partnership” and how do you prove it?

If for whatever reason you don’t have both a cohabitation agreement and wills in place, you may still have a “get out of jail free” card in the form of a universal partnership.

These extracts from the High Court judgment (formatting supplied) set out what you’ll need to prove –

- “A universal partnership is an agreement between individuals to share their property and their gains and losses. The partnership need not be formed for a commercial purpose.

- It regularly comes into existence, whether expressly or tacitly, between unmarried cohabitees, although cohabitation is not essential.

- The requirements for the existence of a universal partnership are the same as those for partnership in general.

- Where a tacit universal partnership is alleged, a court will confirm its existence if the conduct of the parties is such that it is more probable than not that such a partnership agreement had been reached between them.

- A partnership exists if “each of the parties brings something into the partnership or binds themselves to bring something into it, whether it be money, or labour, or skill”; if the agreement is struck for “the joint benefit of both parties”; and if the object of the partnership is material gain.

- The question is … whether, on evaluating those facts as a whole, the probable inference is that there was a universal partnership.”

A bitter family fight shows why it’s second prize

- In the case in question, life partners had for 26 years shared all their assets “akin to a marriage in community of property”. Importantly, they had shared the “benefits and burdens” of a number of property development ventures. They had, said the Court, each brought something into the partnership, her contribution being mostly financial, his (as an architect) mostly in “sweat equity”. Their partnership was not just a life partnership, it “was also plainly at least partly about material gain.”

- Their relationship was terminated by the death of the one partner, who died “intestate” (leaving no will in place) after developing dementia. The other partner had suggested they each execute wills leaving everything to each other and he had done so, but she had declined as she was unwilling to contemplate her mortality

- Her daughter as executor of her mother’s deceased estate refused to recognise any claim by the surviving life partner. Quarrels and evictions followed, with ultimately a hard-fought High Court battle.

- The Court found that the survivor had on the facts succeeded in proving the existence of a universal partnership. Critically, it held that the parties’ partnership “was also plainly at least partly about material gain” and that the surviving partner should anyway inherit half of the deceased’s estate in terms of a principle previously accepted by our courts that “partners in a permanent life partnership in which the partners have undertaken reciprocal duties of support are entitled to inherit as spouses would.”

- Accordingly, the survivor gets a full half of the deceased partner’s entire estate, whilst the daughter is removed as executor and ordered her to pay the legal costs.

The winner is…

The bottom line however is that the element of “material gain” which so clearly applied to the joint acquisition of assets in this particular life partnership will be absent (or at least extremely difficult to prove) in many other cohabitation agreements.

First prize must therefore always be to avoid the risks, delay, stress and cost of trying to prove the existence of a universal partnership and/or reciprocal duties of support by having in place both a comprehensive cohabitation agreement and a joint will or reciprocal wills.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“It’s the profile of the most trusted individual, in a position of trust, like an accountant or bookkeeper. They usually never take leave, and someone who never allows anyone access to their system would go to the length of taking their laptops with them while they are on holiday so that they can continue working. They are usually caught in the moment of forced absence from work.” (Specialised Commercial Crimes Court as reported by News24)

Our courts report a surge in serious cases of theft from employers by their most trusted employees – often bookkeepers and accountants. The greater the trust placed in these dishonest individuals, the more they steal and the longer they get away with it.

Particularly in more serious cases, employers should lay criminal charges as well as instituting disciplinary proceedings. Criminal courts are imposing hefty deterrent sentences, and the Labour Court has confirmed that laying charges does not prejudice the simultaneous disciplinary process.

Minimum sentences apply

Firstly, minimum sentencing provisions apply when large amounts have been stolen. Even first offenders must be sentenced to a minimum of 15 years’ imprisonment for any fraud or theft involving more than R500,000 (R100,000 for persons acting together or R10,000 for law enforcement officers) unless “substantial and compelling circumstances exist which justify the imposition of a lesser sentence”.

Let’s look at some recent cases –

- 50 years for a R537m theft: Over some two decades of employment in a position of trust as an accountant, an employee admitted to 336 counts relating to thefts totalling an astonishing R537m. She had tried to cover up with fraudulent VAT claims and although her lavish lifestyle (she spent R5m on one specific day) attracted attention, it seems that it was only an anonymous tip off that eventually led to her detection and arrest. She was sentenced by a Specialised Commercial Crimes Court (SCCC) to 50 years behind bars.

- 10 years for a R13.4m fraud: A creditor’s clerk, once again in a position of trust, pleaded guilty to 972 counts of fraud totalling over R13.4m and stretching over 9 years, only discovered when she went on sick leave. The mitigating factors in her case (she has health issues and is 65 years old) led the High Court to reduce her 15-year sentence to a below-the-minimum 10 years.

- 18 years for a R14m theft: A financial manager stole over R14m, leaving the couple who had trusted him with their finances without their life savings (including a cancer diagnosis payout) and on their knees financially and emotionally. The Court’s sentence of 3 years more than the minimum reflected its finding that the aggravating factors justified removing the manager from society, despite his gambling addiction and previous clean record.

- 15 to 30 years for a R52m fraud? A trusted store accountant “viewed as a brother” by its traumatised owners (one of whom even contemplated suicide), admitted to two counts of fraud totalling R52m as a result of his gambling addiction. He will only be sentenced in March, but it seems from media reports that he is unlikely to receive less than the minimum 15 years’ imprisonment per count, possibly to run concurrently.

The Labour Court confirms you can do both

A municipal manager with 15 years’ service was criminally charged with very serious frauds. He asked the Labour Court to stop his employer’s disciplinary process against him, arguing that in defending himself at the disciplinary hearing he might have to give self-incriminating evidence.

The Labour Court disagreed, finding that the employee had several layers of protection available to him in the criminal trial, and clearing the employer to proceed with the disciplinary hearing simultaneously. In fact, said the Court, “It is tantamount to an abuse of court process by a person holding a managerial position using court processes to prevent his employer from subjecting him to a disciplinary process under the guise of protecting his constitutional rights.” It accordingly ordered him to pay all costs on the punitive attorney and client scale – a very unusual censure in labour law matters where both sides are normally left to cover their own costs.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Loadshedding continues to plague us and our businesses, and when tenants are connected during power cuts to their landlord’s alternative power source – such as a generator – it is essential for both parties to understand their respective rights.

Lights out for a shopping mall gym

- An upmarket gym had relied for years on its shopping mall landlord’s generator to get through loadshedding, without having to pay extra for it.

- “Out of the blue” the landlord demanded a monthly “diesel recovery levy”, and a dispute arose over whether it was entitled to do so or whether the cost was already covered by an existing “all-inclusive monthly fee for all expenses related to the lease of the premises”.

- The parties agreed to refer that dispute to arbitration but then the landlord decided to flex its muscles by cutting off the gym’s connection to the generator.

- The gym obtained an urgent reconnection order from the High Court. Although that is only a temporary solution for the tenant (it must still win the arbitration or pay the extra levy), the Court’s decision is a significant one in that it has confirmed the principle that access to an alternative source of power does fall under the protection of the “spoliation” principle.

“Spoliation” – no one can take the law into their own hands

No one can go the self-help route and take the law into their own hands by removing property from someone else without a court order. Anyone deprived of possession like that can urgently obtain a “spoliation” order forcing an immediate return to it of the property.

At this stage, the court won’t be interested in who has the legal right to the property – all it will look at is whether –

- The possessor was in “peaceful and undisturbed possession” and

- It was unlawfully deprived of that possession.

That’s straightforward with possession of a “corporeal” thing like a car, or a house, or a parrot. But when it comes to an “incorporeal” like access to an alternative energy source, things become more complicated. Now you must prove that you had “quasi-possession” of the power supply.

As complicated as that may sound, what’s important on a practical level for both landlords and tenants is that this judgment has confirmed in principle that access to an alternative power supply such as a generator falls under the law’s protection as much as possession of a corporeal “thing”.

The bottom line

Whether or not a tenant has an enforceable right to its landlord’s alternative power supply – and if so whether it must pay extra for it – will depend on the wording of the lease.

But the landlord cannot just cut off an existing power supply without following legal process.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“A bad neighbour is as great a calamity as a good one is a great advantage”. (Hesiod, poet of Ancient Greece)

Your neighbour’s business is driving you to distraction. Perhaps it’s loud all-night music, or an invasion of your hard-earned privacy, or illegal parking in your driveway, but regardless of what the nuisance factor is, it really is untenable. You’ve tried everything you can think of to sort it out amicably – polite requests, offers of mediation, compromise proposals. Nothing has worked, and the nightmare continues.

So, it’s off to court you go. Legal action is never first prize when it comes to long-term relationships with neighbours, but if they leave you with no other alternative, take heart from two recent High Court cases. In both, businesses being operated by neighbours in contravention of land use laws were penalised for doing so.

Noisy nightclubs shut down … with some harsh words for the landlord

- A university residence was subjected to noise from nearby nightclubs, with students complaining that loud music prevented them from sleeping and studying until the early hours of the morning.

- The establishments were on property zoned “Use 6: Business 1″ which allowed for the use of the premises as a “Place of Refreshment”, such as a café or bar. But these particular businesses fell into the municipality’s definition of “nightclub”, which put them into the “Place of Amusement” category – for which they were not zoned.

- They argued that their “tavern” liquor licences obliged them to provide entertainment and therefore allowed them a secondary use of the premises as a “Place of Amusement”. The Court disagreed: “the terms of the liquor licence can never override the provisions of the Town Planning Scheme”.

- The premises were accordingly being used outside of their land use rights and were prohibited from continuing to do so, i.e. the nightclubs must close down. If they convert to just being “pubs” they are prohibited from making any noise in excess of the noise levels permitted by the land use rights of the premises.

- Finally, the Court had a harsh word or two for the landlord of the premises in question, which had, it said, remained “supine” rather than enforcing a clause in the lease prohibiting the tenants from creating any nuisance to neighbours. The landlord was accordingly ordered to take “all reasonable measures” to stop its tenants from making a noise nuisance, plus it must pay a share of the costs. That’s a clear warning to all landlords that they risk liability for their tenants’ wrongdoing.

Approvals for a seaside guest house set aside

- The owner of a seaside property realised that not only were her neighbours running a seven-room guest house without municipal permission, but that they planned to go double story with it. “There”, she thought, “goes my privacy”.

- She also feared the negative impact of a guest house on the general character of the area, on traffic volumes and on stormwater management, particularly in light of the guest house’s plan to increase its size to eight suites with parking for sixteen cars.

- The guest house owners had applied to the local authority for a permanent departure from the zoning scheme conditions (their house being zoned “single residential”) and for the removal of restrictive conditions attached to the title deed. The municipality refused to remove the title deed restrictions but granted a conditional approval for the operation of a guest house.

- The homeowner was having none of that and took the matter to the High Court, which found that the local town planning scheme in force at the time (before a new scheme was adopted) did not empower the municipality to grant approval for building or running a guest house on the property. The Court set aside the municipal approvals.

- Both the development and the operation of a guest house on the neighbour’s property were thus declared unlawful. The neighbour, if it still wants to operate the guest house, must now make new applications to the municipality under the “new” town planning scheme for the area. That’s Round 1 to the homeowner, and an expensive lesson for the neighbour.

Before you buy a property…

Whether you plan to run a business from the property you are about to buy or are worried that one of your new neighbours might do so in the future, check what zoning and land use restrictions apply to your respective properties before you put pen to paper!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The greatness of a nation and its moral progress can be judged by the way its animals are treated.” (Mahatma Gandhi)

For many of us our pets are a central part of our lives, our much loved “fur babies”, our companions, exercise partners, even therapists through the hard times.

But what will happen to them after we die? Or if we lose the ability to make the decisions necessary for their welfare? Unless you make specific provision for your beloved pets to address these situations, their fate could be a grim one. When you die for example, the executor of your estate will have no option but to hand pets over to your heirs as “property”. And if your heirs are unable or unwilling to give them a good home and have no guidance from you as to what your wishes are, your beloved pets could end up needlessly euthanised or in a shelter.

Let’s look at a few ways you can avoid that –

A “Living Will for Pets”

In the “when you are gone” section below we will discuss options that only apply after your death, but in contrast a “Living Will” applies when you are still alive but no longer able to make your own decisions.

Thus, your own personal “Living Will” or “Advance Medical Care Directive” sets out what medical treatment you consent to receiving when you are no longer able to speak for yourself.

Similarly, you may want to do something like that for your pets, setting out what is to happen to them when you are no longer able to make such decisions yourself. You could leave specific care instructions (including perhaps veterinary care instructions and authority for euthanasia in specific circumstances) or you could appoint a trusted heir or animal welfare organisation to make those decisions for you. Note that you cannot leave money or assets to anyone in a living will – bequests can only be made in your actual will.

Three alternatives for when you are gone

- A clause in your will: As “property”, your pets cannot inherit from you, but you could provide in your will (“Last Will and Testament”) for a named heir to inherit them, ideally with a bequest to help them cover the costs of pet ownership. Make sure your chosen heir is on board with your plan!

- A directive – in your “important information” file, or in a separate letter of wishes: In addition to your will, you should always leave your executor and heirs a comprehensive file of important information and documents to assist them in winding up your estate. It should include a “My directives” section with instructions as to what is to happen to your pets. Alternatively, you could set that all out in a separate “letter of wishes”. These directions aren’t legally binding on anyone, but they do provide guidance to those winding up your affairs as to your wishes.

- A testamentary trust: This will be overkill for most situations, but if you want to leave a lot of money to care for your pet/s, you might be advised to set up a testamentary (i.e. set up in your will) trust. You would appoint trustees to manage a bequest to the trust, with guidance on how the money is to be spent for your pets’ benefit.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“He who is quick to borrow is slow to pay” (Old proverb)

A recent High Court decision means that, for the first time, creditors of debtor companies are specifically cleared to apply for the company’s directors to be declared “delinquent” in certain circumstances. And that has significant implications for both directors and creditors.

For directors – major long-term career risks

Company directors need to manage a whole range of duties, responsibilities and risks, including being declared “delinquent” in terms of the Companies Act. For more serious categories of misconduct a director risks disqualification from holding any directorship or senior management position for a period ranging from 7 years to a lifetime.

A wide range of less serious categories of misconduct can lead to “probation” orders, with possible disqualification for up to 5 years, supervision by a mentor, remedial education, community service and payment of compensation.

The fact that creditors can now make delinquency applications adds a new level of director risk, the reality being that of all the stakeholders out for blood after a corporate failure, unpaid creditors may well be the fiercest. Your best defence against any personal attack is to always be aware of, and to scrupulously comply with, all your many fiduciary duties.

For creditors – a new door opens

As a creditor on the other hand, your chances of recovering a company debt from a director personally will depend on a range of factors – whether you hold personal suretyships, whether you can prove personal liability for breach of statutory duties and so on (this is a complex topic – specific legal advice is essential).

Now another door has opened to you, and although as we shall see below you will have to convince the court that you are acting in the public interest, it will certainly make directors think twice about defrauding you or exposing you (and creditors and the public generally) to loss through corporate misconduct.

- The case in question stems from the creditors of a company in liquidation failing to recover their debt from it, and consequently taking action against the directors in their personal capacities for over R370m.

- They also asked the High Court to declare the directors delinquent, and one of the directors objected on the basis that creditors have no power to bring such an application. Indeed, the Companies Act gives this right only to a specific list of stakeholders – namely a shareholder, director, company director, secretary or prescribed officer, registered trade union, employee representative, Takeover Regulation Panel, some organs of state and the CIPC (Companies and Intellectual Property Commission).

- The Court however agreed with the creditors that they could apply under another provision of the Companies Act which allows anyone to apply “acting in the public interest, with leave of the court”. On the facts of this particular matter, the creditors were cleared to proceed under that provision.

- In reaching this decision, the Court took account of the (as yet unproven) serious allegations levelled against the directors – extreme breaches of fiduciary duty over a long period of time and involving substantial amounts of money, “a full panoply of misdemeanours” including gross abuse of position and gross negligence, the large number of directorships held by the directors, the (indirect) involvement of public entities – the list goes on.

- Importantly, the Court rejected the director’s argument that “the danger of giving the creditor such standing was that it could use the threat of a delinquency declaration to squeeze the proverbial few extra bob out of the directors.” Every case, said the Court, must be decided on its own facts, and the fact that creditors are suing directors personally does not automatically mean that they are acting cynically and opportunistically.

- But clearly, to succeed you will have to prove that you are acting in the public interest and not just in your own interest as a creditor. It will help to be able to argue, as the creditors in this case did, that “the general public and creditors deserve and require to be protected in their dealings, engagements and transactions with the companies and close corporations of which the defendants are respectively directors and/or members; and … the relief will protect the public from the defendants repeating or replicating their delinquent conduct in other entities.”

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“…moonlighting as a matter of principle is unacceptable…” (extract from judgment)

Up to a quarter of all middle-class South Africans are reported to “moonlight”, that is to run a part-time side hustle or side business in addition to their full-time jobs. Some, it seems, go one step further and manage to hold down two full-time jobs simultaneously. No doubt the pandemic-accelerated increase in remote working has enabled that trend as much as financial pressures on employees have fuelled it.

But, as the Labour Court has once again confirmed, moonlighting without permission risks instant dismissal.

“Juggling two jobs” leads to dismissal after an anonymous tip off

- A “highly qualified and academic” employee held down two part-time lecturing jobs, one with a university. The university had consented to this arrangement, so all was well at that stage.

- However, she thereafter elected to resign from her second part-time job and to take up full-time employment as a lecturer “in a senior position of trust and responsibility” with the university at an annual salary package of R787,520. Almost immediately after that she took on another full-time job as an accounts director at a data consultancy, this time at an annual salary of R1,100,004. Critically, this time she did so without seeking the university’s authority to do so.

- We will never know whether or not the employee might perhaps have got away with juggling these two full-time jobs for any length of time, because after only a month an anonymous tip-off put an abrupt end to her scheme.

- The university convened a disciplinary hearing and she was dismissed after being found guilty of gross misconduct for taking up a second full-time position without the university’s knowledge or authority, in breach of her duty of good faith to the university and of its “Policy on the Declaration of Interests”.

- She referred the matter to the CCMA (Commission for Conciliation, Mediation and Arbitration) which held her dismissal to have been both substantively and procedurally fair – which decision she referred to the Labour Court on review.

- Unimpressed with the employee’s defence that she could manage the two positions, that she did not think it would prejudice the university, and that she saw no conflict of interest, the Court agreed that she had been guilty of “extremely serious misconduct” and upheld her dismissal.

- Rubbing salt into her wounds, the Court ordered her to pay the university’s legal costs (unusual in labour law matters).

Moonlighting – a breach of duty and good faith

The Court’s findings apply to all employment contracts, even those without specific moonlighting policies in place, because of the breach of trust inherent in unauthorised moonlighting. To quote the Court in bullet point form –

- “In simple terms, moonlighting as a matter of principle is unacceptable, and a breach of an employee’s fiduciary duties towards the employer.

- It must always be the sole prerogative of an employer to decide whether to allow this to take place, and also on what terms it may be allowed.

- Nothing can be assumed by the employee. That is why it has to be critical that full disclosure be made by the employee to the employer beforehand, so the employer can exercise its prerogative in an informed manner.”

- To make disclosure to an employer after the fact effectively confronts the employer with a fait accompli, and cannot undo the breach of the duty of good faith that has already taken place.”

Is dismissal always appropriate?

To quote the Court again: “It would in my view be difficult for an employer to re employ an employee who has shown no remorse. Acknowledgment of wrongdoing is the first step towards rehabilitation. In the absence of a recommitment to the employer’s workplace values, an employee cannot hope to re-establish the trust which he himself has broken. Where, as in this case, an employee, over and above having committed an act of dishonesty, falsely denies having done so, an employer would, particularly where a high degree of trust is reposed in an employee, be legitimately entitled to say to itself that the risk of continuing to employ the offender is unacceptably great.”

In this case the employee’s consistent denials of wrongdoing left the university, said the Court, with no alternative but to terminate her employment. But clearly dismissal will not automatically be appropriate in all cases, particularly where it is possible to re-establish trust in a case of genuine remorse. Every case will be different and specific legal advice is essential.

Consistency is critical

Employers need to be able to justify any inconsistency in approach to similar misconduct by other employees. In this case the employee’s “consistency challenge” was groundless and rejected, but it will always be a factor in assessing whether or not dismissal is appropriate.

A final note for employees

If you need or want to earn some extra cash on the side, tell your employer and get prior consent (in writing). Or risk dismissal.

And a final note for employers

Follow the principles set out above and think of putting something into your employment contracts to cover all possible “conflict of interest” situations including moonlighting. With the complexity of our labour laws and the downsides of getting it wrong, specific legal advice is essential.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews