December and January have always been prime months for selling residential property in South Africa, and if you are a “Festive Season Seller”, here are two really important tips for you.

- Plan your finances

Understand and plan for all the financial implications, not just the legal ones.Prepare a cash-flow forecast so that you know what you will receive and when, and what you will have to pay and when. Your forecast will tell you what funds you must have available at all stages of the sale and transfer process, and it will answer your bottom-line question – what will be left in your pocket at the end of it all?

- Don’t forget your CGT liability

There are many expenses you should provide for (ask your lawyer to help you list them), but in this article we’ll only address one of them – the CGT (Capital Gains Tax) aspect.This is vital – if you made a “capital gain” on the sale (more on how to calculate that below) you could be liable to pay CGT. If so, it could well be a substantial liability, and not planning for it will leave you in a world of pain because if you can’t pay your tax bill SARS will be after you with a big stick (SARS has extensive powers when it comes to debt collection).

There is a bit of good news: The advantages of owning your own family home, and the value of property generally as an investment channel, will for most people outweigh the pain of having to pay tax when you eventually sell. Plus, as we shall see below, paying CGT on a property sale is not nearly as painful as it would be to pay income tax on it. Indeed, if the capital gain on your primary residence is R2m or less, your CGT bill is nil!

How does CGT on a property sale work?

This is a complex topic, so what follows is of necessity a summary of general principles only – there is no substitute for specific professional advice here!

- What is Capital Gains Tax? CGT forms part of your income tax and is a tax on any “capital gain” you make on an asset, in this case a property. The capital gain is the difference between your base cost and the proceeds of your sale.

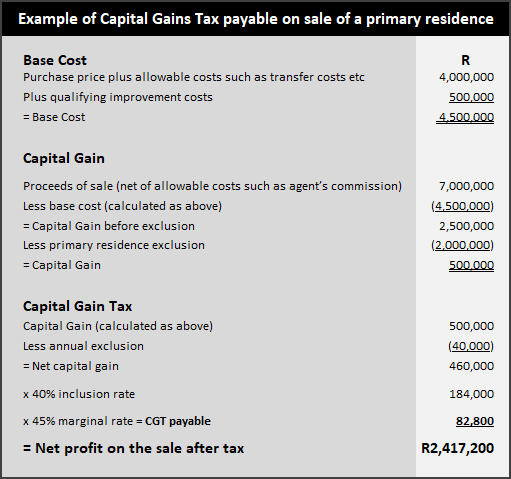

- What is “base cost”? This is what your property cost you to acquire (including transfer costs, transfer duty and the like) when you bought it. Note that CGT only kicked in on 1 October 2001, so if you bought the property before then it is the property’s value at that date that you will use. Qualifying improvement costs (extensions, additions and the like but excluding maintenance or repair costs) are also added to your base cost, so keep a separate note and proof of these as you incur them over the years. Our example calculation below assumes a homeowner who bought a number of years ago for R4m inclusive of transfer costs and duty, then spent a total of R500k on improvements (perhaps adding an extra room and a swimming pool).

- How do you calculate the “sale proceeds”? From the sale price you can deduct any costs of selling which are directly related to the sale, such as agent’s commission, advertising, legal costs and so on. In our example we assume net sale proceeds of R7m.

- How do you calculate the “capital gain”? This is the difference between the base cost and the proceeds of the sale (R2.5m in our example, before the primary residence exclusion).

- What can you deduct from the capital gain? If the property is in your personal name and is your “primary residence” (i.e., where you normally live) you can deduct a R2m exclusion from the capital gain. Note that if you used your house for business purposes or if you didn’t reside in it for the whole period of ownership, you need to take specific advice on how much (if any) of the exclusion is available to you. You can also deduct an “annual exclusion” of R40,000. In our example we assume the seller is entitled to both exclusions in full, resulting in a net capital gain of R460,000.

- How are you taxed on the net capital gain? The example below will help clarify this. Your capital gain is added to your annual income tax liability at the “inclusion rate” applicable to you. Individuals and special trusts have an inclusion rate of 40%, whereas other trusts and companies have an inclusion rate of 80%. You will then pay tax on that amount at your marginal tax rate (18% – 45% depending on your taxable income). In our example we assume an individual taxpayer paying tax at the highest marginal rate of 45%, the resulting tax liability of R82,800 amounting to just under 1.2% of the net sale proceeds. Our seller’s profit on the sale net of tax would then be R2,417,200.

So how much CGT will you actually pay?

For an individual your calculation is: Capital Gains Tax = Capital Gain x 40% inclusion rate x your marginal tax rate.

Have a look at the example below which assumes an individual home seller entitled to the full R2m primary residence exclusion and paying tax at the highest marginal tax rate of 45%. Then use your own figures and make your own calculation.

(Source: Adapted from SARS examples)

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNew

“Are we being good ancestors?” (Jonas Salk)

What do you plan to give your family this Festive Season? Now’s the time to think beyond the brightly wrapped gifts under the tree and get started on an estate plan which will leave your loved ones the lasting gift of financial freedom.

Estate planning involves a lot more than just executing a valid will, but let’s start off with a reminder that a will must always be your top priority.

Your will is the heart of your estate plan

You will have heard this many times before, but it bears repeating. Your will (“Last Will and Testament”) could well be the most important document you ever sign. Without executing a will, you forfeit your right (and duty) to decide how your assets will be distributed so as to ensure the future happiness and well-being of your loved ones. You lose your opportunity to choose an executor you can trust to wind up your estate professionally and efficiently. And no matter your age or state, it cannot wait – no one knows when the fateful day will dawn.

Most importantly, your will lies at the heart of your entire estate plan. It underpins and powers it. So, if you don’t yet have a will in place (or if your will needs updating) make your number one priority: “Book an appointment with my lawyer. Now.” Then ask your lawyer to draft your will to form the core of your overall estate plan.

What is an estate plan and why should you have one?

Your estate plan is your roadmap to creating wealth, to protecting it, and to transferring it to the next generation (or beyond). It is the only sure-fire way of ensuring your own comfortable retirement and of providing for the financial wellbeing of your loved ones after you are gone.

It incorporates your overall financial strategy, answering questions such as how you will save and invest, what investment options you will choose, how you will acquire assets, how you will provide for tax and other liabilities, how you will ensure effective succession planning in your business, how you will transfer your wealth to the next generation and so on.

Bring your family in early

It’s never easy contemplating one’s own mortality but in fairness to your loved ones make sure that as soon as they are old enough to participate, everyone is part of the process. Bring them in on everything you can and keep them in the loop when you are tracking progress or thinking of changing anything.

Questions to ask yourself

As the old adage has it “Failing to plan is planning to fail”. So plan. Start by asking yourself (and your family) these questions –

- What is our end goal?

- How much wealth do we need to build up?

- What is our target date for reaching that goal?

- How will we achieve it?

Now formulate your financial mission statement

Use your answers to those questions to formulate a “financial mission statement” and a detailed strategy to get there. As always with goal setting, break the big goals down into little ones, with target dates for achieving them and ways of tracking your progress.

Done and dusted! But wait, how will you actually transfer that wealth to the next generation (or beyond)?

Preserving your wealth for the next generation – and beyond

For many, it’s only realistic to plan one or two generations ahead. But whether your aim is to provide financial cover for just your spouse and children, or for your grandchildren as well, or (let’s aim high here!) for your great grandchildren and beyond, your estate plan should lay out a clear strategy for preserving your wealth down the generations.

Trusts are often recommended for generational wealth preservation and transfer, and whilst they have pitfalls and should only be considered with professional advice, they can certainly provide a powerful solution. In particular they could result in substantial estate duty savings for many generations down the line. Similarly, corporate structures (companies, company/trust combinations and the like) are often used for this purpose, particularly when trading businesses are involved. Donations during your lifetime may be suggested but beware the tax implications. Living annuities enable you to nominate beneficiaries to receive the benefits (with a tax incentive for them to leave at least part of the funds invested). There may be other niche solutions to suit your particular needs.

The bottom line

There are many complex decisions to be made and there is no “one size fits all” solution. Every family’s situation and needs will be unique. Every class of asset and every wealth-transfer vehicle carries with it particular requirements, benefits, risks and cost and tax considerations.

Professional advice specific to you and your family is essential!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“This is a running down case: literally” (Extract from judgment below)

The scene is Cape Town’s iconic Sea Point Promenade. An elite runner participating in a race knocks down a pedestrian out for a Sunday walk, causing serious injuries. The pedestrian sues both the runner and the race organiser for damages of R718,000.

The outcome is another reminder to us all to be aware of our surroundings at all times – a moment’s inattention can change everything in a split second. As the facts here illustrate…

The race-day collision and the R718,000 claim

- Although the Court heard conflicting evidence as to detail, the setting for this unfortunate collision was common cause. A popular public space on a Sunday, replete with not only the normal pedestrians, cyclists, dog walkers and kite-flyers, but on this particular day also thousands of participants in a “Ladies Race”, ranging from athletes competing in an “elite race” to costumed “Fun Walk” entrants.

- Going for a Sunday stroll with a friend and “in the wrong place at the wrong time” whilst blissfully unaware of the misfortune about to be visited upon her for her act of goodwill, the claimant happily consented to a request from a group of “Fun Walk” participants to take a “happy snap” of them.

- Picture taken, she moved across the sidewalk to hand the camera back to its owner and a participant in the “elite race” ran straight into her, then ran off to finish her race.

- Suggestions that the runner (approaching it seems at about 20 kph) shouted a warning to the effect of “get out of my way” and forcefully pushed the claimant aside were in dispute, but what was clear was that she was knocked to the ground and sustained a hip injury which resulted in an ambulance trip to hospital and hip replacement surgery.

- The claimant sued both the runner and the race organiser for R718,000 in damages. The Court’s findings hold lessons for us all.

The race organiser off the hook

On the evidence, the race organiser and the race Marshall in the vicinity of the collision were cleared of any negligence.

The runner’s negligence

The runner, found the Court, was in a public space and should have been alive to the possibility of encountering other sidewalk users at close quarters. She had a duty to keep a proper look out and should have taken into account “the nonchalance and lack of interest of ordinary pedestrians who were out and about enjoying the fresh air rather than watching an athletics race. Ordinary human experience tells one that such persons might behave irrationally and get in the way, as it were.” (Emphasis added).

The runner was negligent in focussing only on the ground immediately ahead of her, “running as if in a bubble, oblivious to what was happening around her and intent only on achieving her goal of winning the race.” She could have avoided the collision with little effort and without seriously affecting her chances in the race.

The pedestrian’s 70% contributory negligence

However, in all the circumstances the Court held that the claimant (actually the executor of her estate as she had later died from unrelated causes) was only entitled to 30% of whatever damages could be proved.

She had been, said the Court, considerably more negligent than the runner. She had to be aware of the race, she knew runners were “whizzing” past her, and she had been warned of runners coming through.

The old ironic saying “no good deed goes unpunished” springs to mind, but the hard fact (in life as in law) is that we are often the architects of our own misfortune.

Be aware of your surroundings at all times!

It’s a hard lesson, but the law holds us to certain standards, and one of those is to keep a proper look out, particularly when in a public space. A moment’s inattention, and in a split second your life could change forever, with physical injuries compounded by the risk of damages claims and counterclaims of contributory negligence.

Take legal advice immediately if you are unlucky enough to be involved in an incident causing injury or other loss!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Before you close up for the year, remember that if you are a “designated” employer, your Employment Equity Act (“EEA”) Report is due on 15 January 2023.

Failure to comply carries substantial penalties so don’t miss this deadline.

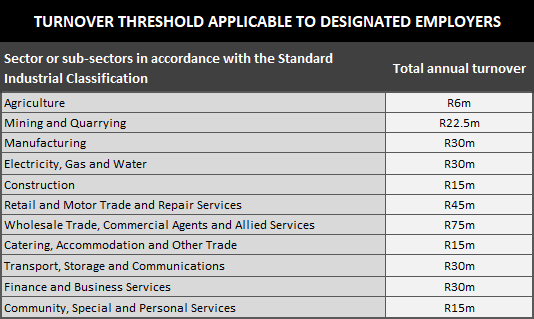

You are likely to be a designated employer if either –

- You have 50 or more employees, or

- Your annual turnover equals or exceeds your particular industry’s threshold. See the table below for details.

(Source – Schedule 4 to the Employment Equity Act)

There’s good news for some SMEs in the pipeline

Good news for smaller businesses drowning in red tape it that it seems likely that the threshold test will fall away at the end of September 2023. If you have less than 50 employees, that would let you off the reporting hook from October next year. But for now, if you are in the turnover net, meet the 15 January deadline.

Bear in mind also that all employers, designated or not, must comply with the EEA’s strict prohibitions against unfair discrimination.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“You can tell a lot about a person by the way they handle three things: a rainy day, lost luggage and tangled Christmas tree lights.” (Maya Angelou)

December holidays are a time for winding down, recharging your batteries and sharing some quality family time. But it can also be stressful. There’s a reason we often talk about the “Silly Season”.

Don’t let the pressure get to you! Relax, take a deep breath, and read “10 tips to reduce festive season stress” on the Lionesses of Africa website.

Whatever else you do, enjoy your break!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“I love deadlines. I love the whooshing noise they make as they go by.” (Douglas Adams)

Here’s yet another reminder from our courts on the danger of not complying strictly with every provision in a property sale agreement. Don’t be like Douglas Adams and listen to the deadlines go whooshing by – missing a property sale deadline is a mistake, probably an expensive one. The deadline set by every bond clause is no exception…

Sale’s a dead duck. Who gets the R600,000 deposit?

- A property sale agreement contained a standard “suspensive condition” in the form of a bond clause making the sale conditional upon the buyer obtaining R1.5m in bond finance by a specified date. The buyer could waive the benefit of this clause, and if it wasn’t fulfilled or waived by the deadline date the sale would become null and void – in which event the deposit, with interest, was to be repaid to the buyer within 5 business days.

- The buyer paid the R600,000 deposit to the estate agent, but had difficulty in raising finance and (before the deadline expired) asked for more time to get the necessary bond approval. Both parties assumed that an extension of the deadline had been validly granted, but in fact there was never any compliance with the requirement in the bond clause that any extension be by “written agreement”. In other words, the sale had lapsed, but neither the seller nor the buyer realised that – they both thought they still had an agreement in place.

- Two months later, thinking that the sale was still alive and well, the buyer signed a waiver giving up the benefit of the bond clause and stating that the agreement was no longer subject to the suspensive condition.

- Another two months down the line the buyer told the seller he was no longer proceeding with the purchase (his wife had in fact bought another property in the interim). The seller took that as a repudiation of the contract and cancelled the sale.

- The buyer demanded his deposit back. The seller wanted it forfeited to him. Off to the High Court they went.

The law, and the result

- The general rule in our law is that no agreement comes into existence unless and until all suspensive conditions are fulfilled. So the seller has no claim against the buyer unless either the sale agreement provides for such a claim (unlikely) or “where the party has designedly prevented the fulfilment of the condition.”

- That, in lawyer-speak, is the legal principle of “fictional fulfillment of a suspensive condition”. In lay terms – the law protects the seller and doesn’t allow the buyer to escape from the sale by deliberately ensuring that he doesn’t get a bond.

- The seller argued that that was exactly what the buyer in this case had done; that he had breached the agreement and had deliberately frustrated the fulfilment of the bond clause.

- On the facts however, the Court held that both seller and buyer had remained committed to the sale, blissfully unaware that in law the sale agreement was already a dead duck. The buyer only decided to get out of the agreement after it had already lapsed.

- The buyer gets his deposit back with interest, and the seller is left with an unsold property and a large legal bill.

Buyers – your risk

As the Court put it, what saved the buyer in this case was a lack of evidence that the buyer had – by commission or omission – prevented the necessary finance from being granted. In other words, you risk being sued (which will put your deposit at risk) if you don’t make a genuine effort to get the necessary bond finance by the due date.

Sellers – keep an eye on the bond clause deadline

The seller on the other hand is left to lick his wounds after all the delay, cost and effort this dispute has caused him. He could have avoided all that pain by keeping an eye on the due date and ensuring that the deadline extension was agreed to in writing before it expired. As the Court pointed out “The contract was readily available to all involved and the requirements of clause 6.3 pertaining to an extension were available for all to read. A simple investigation would have revealed what was required.” (Emphasis added).

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Marriage is a matter of more worth / Than to be dealt in by attorneyship” (Shakespeare)

Wedding Season is well and truly upon us, and if you (or anyone near and dear to you) is busy planning for marriage (note that we are talking “civil marriage” here, “customary marriages” and “civil unions” are beyond the scope of this article), you will have a long “To Do” List to work through. Venue, invites, catering, flowers, service, this, that, the other. The list goes on, and on…

But no matter how long or complicated your Wedding Plan may get, make sure that “Get All the Boring Legal Bits Sorted” is high on your priority list. Yes, this is the not-fun part of all this, and getting to grips with all the legal niceties is a chore.

But whilst we can all agree with Shakespeare’s observation that “Marriage is a matter of more worth / Than to be dealt in by attorneyship”, understanding and managing the legal consequences of marriage remains absolutely vital.

So, where to start? Ask your lawyer three questions –

1. “Do we need an ANC?”

Whether you need an ANC (antenuptial contract), and if so, what should be in it, will depend in part on which “marital regime” you choose.

This is a critical decision. Which regime you choose now (and you must choose before you marry) will affect you and your family long after the ink dries on your marriage certificate. It will affect all of you throughout your marriage, and it will affect everyone when your marriage eventually comes to an end (whether by divorce or death – both grim prospects, but realities that must be faced).

Our law presents you with three alternatives, and professional assistance is essential here because your choice involves a complex mix of individual preference, circumstance, and personal and financial status –

- Marriage in community of property: All of your assets and liabilities are merged into one “joint estate” in which each of you has an undivided half share. On divorce or death the joint estate (including any profit or loss) is split equally between you, regardless of what each of you brought into the marriage or contributed to it thereafter. This is the “default” regime – so you will automatically be married in community of property if you don’t specify otherwise in an ANC executed before you marry. This regime will suit some couples, but most will be advised to rather choose one of the other options (b or c below).

- Marriage out of community of property without the accrual system: Your own assets and liabilities, both what you bring in and what you acquire during the marriage, remain exclusively yours to do with as you wish. Note here that the “accrual system” (see option c below) will apply to you unless your ANC specifically excludes it.

- Marriage out of community of property with the accrual system: As with the previous option, your own assets and liabilities remain solely yours. On divorce or death you share equally in the “accrual” (growth) of your assets (with a few exceptions) during the marriage.

P.S. Already married? As a side note, if you happen to be married already and you now want to change your marital regime – perhaps you have only now found out that you are by default married in community of property and you realise what a mistake that was in your case – you may still be able to fix things. Ask your lawyer if you might be able to enter into a postnuptial contract. You are in for an expensive court application and requirements apply, so rather make the right choice before you marry.

2. “Are our wills in order?”

Marriage is one of those life events that focuses the mind on how important it is to have valid wills (or perhaps one “joint will”) in place. Existing wills need immediate review. Of course, your will (“Last Will and Testament”) is only the first step in a full estate planning exercise, but it is the foundational step, so prioritise it.

Don’t be tempted to procrastinate on this one – as the old saying has it “Death Knocks at All Doors”, and often it knocks without warning. There’s no other way to ensure that your loved ones will be fully protected and catered for after you are gone.

3. “Can we choose new surnames?”

As a man, you can only change your surname by application to DHA (the Department of Home Affairs) but as a woman you can automatically –

- Take your husband’s surname, or

- Revert to or retain your maiden surname or any other prior surname, or

- Join your surname with your husband’s as a double-barreled surname.

Ask about the legal ramifications of your choice and tell the marriage officer upfront what your choice is so that your marriage certificate, marriage register and National Population Register all reflect your married name correctly.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“For many, many people, I’m a firm believer that 60 is the new 50.” (Carolyn Aldwin, director of Oregon State University’s Center for Healthy Aging Research)

As even the youngest Boomers (the generation born between 1946 and 1964) approach the “Big Sixty”, an increasing number of employees will be thinking about whether or not they want to retire. And an increasing number of employers will be wondering whether to ask them to stay on or to retire them (and if so, when).

Bear in mind that our law does not recognise any concept of a general “normal/standard retirement age” and that you need to tread carefully here because a dismissal is automatically unfair if the reason for the dismissal is that the employer unfairly discriminates against an employee, directly or indirectly, on any arbitrary ground such as age.

Our courts look upon automatically unfair dismissals with particular disfavour, and a guilty employer can expect harsh penalties.

When is age-related dismissal fair?

As an employer you can avoid a finding of automatically unfair dismissal if you prove –

- That there is a clause in your employment contract specifying an agreed retirement date, or

- That there is a “normal or agreed retirement age” for employees “employed in the capacity of the employee concerned”, and

- That the dismissal is based on age and not, for example, a disguised retrenchment or dismissal for some other reason.

What if your employee wants to stay on after retirement date?

“Sixty really is the new Fifty” says at least one recent scientific study, and it certainly is the case that many employees want to carry on working long after 60 or 65. Sometimes economic necessity is the motivation, sometimes a need to carry on being useful, sometimes just a reluctance to “retire and go fishing”.

Equally, many employers are reluctant to lose the experience, loyalty and talent of senior staff and will happily accept a request to stay on.

However, a recent Labour Appeal Court case confirms the need for all concerned to tread carefully in such a situation –

Dismissed 9 months after reaching 60

- An employee turned 60 but carried on working and being paid as normal. No mention was made of the fact that he had reached the agreed retirement age set out in his employment contract.

- Nine months later however, his employer told him that his services would now terminate as he had reached the agreed retirement age.

- He disputed this as an automatically unfair dismissal, arguing in the Labour Appeal Court that a new employment contract or “tacit” (implied) contract had come into effect, and that this contract extended his employment indefinitely or at least to 65. Alternatively, he said, his employer had waived (relinquished) the retirement clause.

- The Court disagreed, holding that the employment contract and its agreed retirement date had continued uninterrupted, with both employer and employee having a right to terminate employment at any time thereafter.

- Per the Court: “The focus is not so much on when the employee reached his or her retirement date, but rather that the employee has already reached or passed the normal or agreed retirement age.” There was also nothing in the conduct of the parties to suggest they had entered into a new tacit contract or that the employer had waived its rights.

- The employee’s enforced retirement stands.

An action list for employers

- Avoid a situation where your employee can no longer do the job but there is no agreed retirement date. That would leave you trying to prove a valid ground for dismissal – incapacity or incompetence perhaps. Not easily done, and traumatic for you both.

- Moreover, it’s not always easy to prove what a “normal” or “standard practice” retirement age is for your industry and circumstances. Much safer to have a specific retirement clause in all your employment contracts.

- Don’t try to unilaterally impose retirement clauses on employees if their existing contracts don’t already have them – this is a matter for negotiation and agreement.

- Diarise each employee’s retirement date and before that date rolls around, either make it clear to the employee that their employment is about to end automatically or put in place a new employment contract.

Notes for employees

- If you work beyond an agreed or normal retirement age, the harsh reality is that you are, as the Labour Court has put it before “working on borrowed time”.

- Without a written agreement, setting out clearly when your new retirement date is, you have no guarantee that your post-retirement employment is in any way secure or legally protected.

As always with employment law matters there are complexities, grey areas and substantial downsides to getting it wrong, so seek specific professional advice!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The Constitution guarantees that administrative action will be reasonable, lawful and procedurally fair. It also makes sure that you have the right to request reasons for administrative action that negatively affects you.” (Department of Justice and Constitutional Development)

Bureaucratic decisions can and do have far-reaching consequences for us, both financially and in our personal lives. It’s good to know therefore that whenever your rights are affected by any such decision, you have access to the protections set out in PAJA (the Promotion of Administrative Justice Act).

In a nutshell, PAJA provides that “administrative decisions” by government departments, parastatals and the like must be fair, lawful and reasonable. Decision makers must follow fair procedures, allow you to have your say before deciding, and give you written reasons for their decisions when asked.

If a decision goes against you, your first step should be to use any internal appeal procedures. Ultimately you can go to court, although often a lawyer’s letter or two will solve the problem without the need for litigation.

A recent High Court decision illustrates one way in which PAJA can help you if all else fails –

A service station’s building plans rejected

- A service station submitted to its local authority building plans for a proposed refurbishment.

- After a series of meetings with the municipality and alterations to the plans as various issues were raised and resolved, the service station owners thought they were home and dry. But in the end the plans were not accepted on the basis that the application was for an extension of the service station which could not be approved in terms of the local Town Planning Scheme.

- The High Court however found that factually there was no “extension” involved and that the municipality had therefore made an “error in law”.

- That opened the door for the Court to review the municipality’s decision, which it duly set aside. In referring the decision back to the municipality for reconsideration, the Court directed it to make a decision within 21 days, and without regarding the proposed refurbishment as being an extension of the building.

A final thought – strict time limits apply with PAJA, so if a decision goes against you seek professional help without delay!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

No matter how good your product and your service levels, the hard reality in business is that customer issues will arise. Perhaps they will be genuine problems or perhaps they are just misperceptions, but either way you need to act quickly and effectively to resolve them. Particularly in these times of online reviews making or breaking reputations so quickly and easily.

Here’s a tried and tested method to boost customer satisfaction generally, to change complaints into compliments, and to resolve all forms of conflict (it is equally useful for workplace and personal issues) with kindness and respect.

Read “How to Use the HEART Method to Improve Customer Satisfaction” on The Real Time Report’s website.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews