“Taxpayer: One who doesn’t have to pass a civil service exam to work for the government” (Anonymous)

“Tax Freedom Day” is the first day of the year on which we South Africans (we’re talking about the “average” taxpayer here) have finally earned enough to pay off SARS and to start working for ourselves.

This year the predicted date was 12 May 2022. That’s three days later than last year, and a whole calendar month later than in 1994 when we first started recording this.

That’s a depressing trend, but it’s a worldwide one and we certainly aren’t the worst-off country – Belgians for example only get to celebrate on 6 August! Certainly food for thought for anyone thinking of emigrating. Have a look at Wikipedia here for some country-by-country comparisons.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

We all know how vital it is to use strong passwords online, but for a sobering look at just how quickly the “average” cybercriminal can hack any that aren’t up to scratch, go to Hive Systems’ article “Are your passwords in the Green?” here.

Their “Time it takes a hacker to brute force your password in 2022” infographic provides a strong visualization of the weakness and strength of various lengths and types of passwords. Also read the warnings and infographic in the section halfway down the article “What about the elephant in the room; what if my password has been previously stolen, uses simple words, or I reuse it between sites?”

Essential knowledge in these days of soaring online crime!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The said penalty … was imposed due to the fact that the property was being used in contradiction to its zoning” (extract from judgment below)

Municipalities all have the right (and the duty) to regulate land use in their areas, and amongst other sanctions, properties that are used unlawfully or without authorisation can be subjected to rates and charges on a penalty tariff.

These penalties can be steep, and the Supreme Court of Appeal (SCA) has now held that they can be imposed without the municipality first having to change the property’s category on its valuation roll to “illegal or unauthorised” use. All it has to prove is that it acted in terms of a lawful rates policy.

The house whose rates bill quadrupled

- A house valued (on the municipality’s valuation roll) at R1,650,000 had its monthly rates bill quadrupled from R898-01 to R3,592-05.

- The municipality took this step after notifying the owners of their “wrongful and unlawful use of the property as a student commune, in contravention of the town planning scheme and zoning thereof without the necessary authorisation.” Authorisation was necessary, said the municipality, because the commune was a “commercial concern”.

- This after the owners had let out two of their five bedrooms to “students or young professionals” and had continued to do so despite two years’ worth of notices from the municipality to terminate the unlawful use, and despite a High Court interdict against the continued contravention.

- The legal challenge mounted by the property owners against the penalties was based on a series of legal arguments, and the Court’s analysis thereof (on appeal from the High Court) will be of great interest to property professionals.

- For property owners however, the practical punchline is that the SCA upheld the penalty charges, and the owners must pay them.

If your neighbour breaches land use laws…

That punchline is also important for neighbours, because in practice unlawful land usage of this nature will often only come to a municipality’s notice when a concerned neighbour blows the whistle.

So, if you think your neighbour is about to open up an unauthorised office, commercial or other non-permitted operation next door, and if you can’t settle the matter peaceably over a cup of neighbourly coffee, call in professional help immediately. Just the threat of a quadrupled rates bill could be enough to make the problem go away.

Different strokes for different municipalities

Property owner or neighbour, find out what your local authority’s land use and rates policies are. This particular case related to the City of Johannesburg Metropolitan Municipality, and your local municipality will have its own land use bye-laws, which could well be less or more restrictive than Joburg’s.

Check the zoning before you buy property

Perhaps the property owners in this case planned all along to let out rooms, and perhaps that extra income is what put this particular house within their financial reach. If so, the mistake they made was in not checking the local zoning upfront.

Knowing the zoning and building restrictions in your chosen area is also vital if you want to avoid unpleasant surprises, like a new neighbour opening up a guesthouse or building a triple story which cuts off your sea views. Ask your lawyer to check for you before you offer.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The criterion that harassment involves unwanted conduct distinguishes acts of harassment from acceptable conduct in the workplace” (extract from the Code, emphasis added)

With effect from 18 March 2022, a new “Code of Good Practice on the Prevention and Elimination of Violence and Harassment in the Workplace” came into effect. Every employer and employee should know about it.

The new Code has replaced the old “Code of Good Practice for the Handling of Sexual Harassment Cases in the Workplace”. It is much wider in every way possible because it “… is intended to address the prevention, elimination, and management of all forms of harassment that pervade the workplace” (extract from the Code, emphasis added).

Of necessity, what is laid out below is no more than an overview of an extremely complex topic so in any doubt seek professional advice specific to your circumstances!

In a nutshell…

There’s a lot more detail below, but in essence –

- The Code applies to all employers, employees, and workplaces (office-based or remote)

- Its reach is extremely wide in prohibiting any and all forms of workplace harassment

- Employers have a raft of duties to comply with in relation to assessing workplace risks of harassment, and in formulating and applying procedures to prevent and deal with it

- Failure to comply risks substantial liability.

Who does the Code apply to?

In a nutshell, it applies to pretty much everyone involved in any business with one or more employees, the Code making it clear to start with that all employers and employees, in both the formal and informal sectors, are included.

Specifically mentioned as possible perpetrators and victims of harassment, in addition to employers and employees, are owners, managers, supervisors, job seekers and job applicants, persons in training including interns, apprentices and persons on learnerships, volunteers, clients and customers, suppliers, contractors, and (the very wide catch-all at the end) “others having dealings with a business”.

When and where does it apply?

It applies virtually everywhere, including remote and out-of-office situations – “in any situation in which the employee is working, or which is related to their work”, including the workplace itself (widely defined), “work-related trips, travel, training, events, or social activities”, “work-related communications, including those enabled by information and communication technologies and internet based platforms”, employer provided accommodation and transport, and “in the case of employees who work virtually from their homes, or any place other than the employer’s premises, the location where they are working constitutes the workplace.”

What must you as an employer do about it?

In broad terms you must –

- Take proactive and remedial steps to prevent all forms of harassment in the workplace

- Conduct an assessment of the risk of harassment that employees are exposed to while performing their duties (emphasized as this is probably the best place to start!)

- Apply an attitude of zero tolerance towards harassment

- Create and maintain a working environment in which the dignity of employees is respected

- Create and maintain a climate in the workplace in which employees who raise complaints about harassment will not feel that their grievances are ignored or trivialized, or fear reprisals

- Adopt a harassment policy, which should take cognisance of and be guided by the provisions of the Code

- Develop clear procedures to deal with harassment, which should enable the resolution of problems in a gender sensitive, confidential, efficient, and effective manner.

If you don’t tick all of those boxes, you risk substantial liability not only under our employment laws but also under the general principles of “vicarious liability” in the form of liability for any employee misconduct causing harm to others.

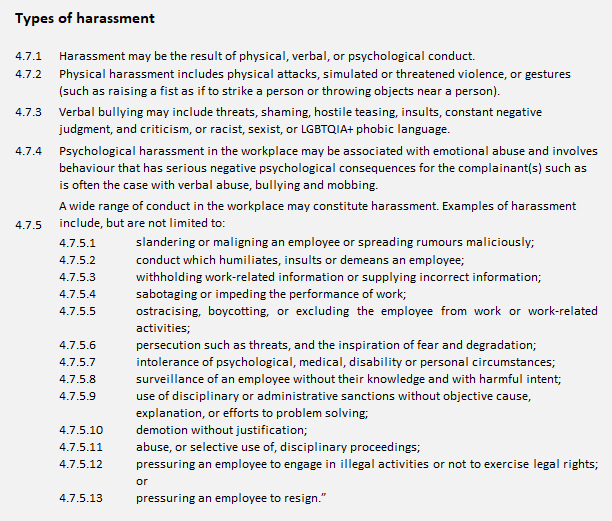

What is “harassment”?

The following extract from the Code gives an idea of just how broad the general definitions of harassment are –

What is “sexual harassment”?

Again, the definitions here are extremely wide and include any form of unwanted conduct of a sexual nature including physical, verbal, or nonverbal conduct, whether expressed directly or indirectly.

Specific examples that seem to have attracted the most media attention include sexual innuendos, comments with sexual overtones, sex related jokes, whistling of a sexual nature, sexually explicit texts, and “unwelcome gestures”, but there are many more.

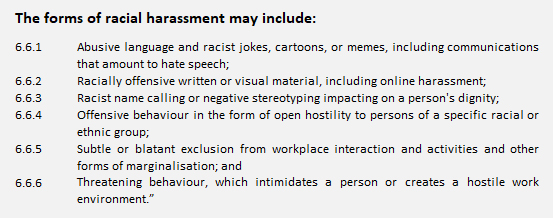

What about “racial, ethnic or social origin harassment”?

Again, the definitions are wide here, including the concept that “Racial harassment is unwanted conduct which can be persistent or a single incident that is harmful, demeaning, humiliating or creates a hostile or intimidating environment” and illustrated by this extract from the Code –

Bottom line: If you think something could possibly be classified as “workplace harassment”, it almost certainly will be!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“A Legacy Letter is a way for you to share your values, life lessons, cherished memories, hopes for your family’s future, and anything else that is really important to you.”

Estate planning is key to ensuring that your loved ones are properly catered for after you are gone. Ideally go beyond the practical and financial issues and also leave something personal, something of yourself.

Follow these three simple steps to ensure that you don’t just leave behind assets, but also a lasting and valuable legacy –

- Firstly, leave a valid and updated will (“Last Will and Testament”). It’s the core and the foundation of your plan to protect the people you care for.

- Next, address the financial and practical aspects. Will each of your loved ones have enough to support them? Will there be enough cash in your estate to ride out the inevitable delays in winding it up? Are children and any other vulnerable family members protected? Have you taken advice on setting up trusts? Do you have enough life insurance in place? Have you left a full “Important Information File” to help your executor and your family take control of and finalise your estate?

- Now go one step further – don’t just leave an estate, leave a legacy. Read “How to Preserve Your Life’s Lessons for Future Generations” on Mission Wealth for ideas on how to share a meaningful “Legacy Letter” with your family. Follow the links in that article to “Leaving a Legacy” and “The New Way to Leave a Lasting Legacy”.

Let’s close with these words of wisdom from that article: “The golden rule of all estate planning is: Don’t wait.”

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The terms of the contract are the decisive criterion by which any potential expiry of a deadline has to be determined” (extract from the judgment below)

A recent High Court decision provides yet another reminder to have your property sale agreement drawn (or at least checked) by a professional. Before you sign anything!

As is the case in many such property sale disputes, it started with one of the parties – in this case the seller – looking for a way to escape the agreement after getting cold feet.

The seller tries to escape the sale

- The sale agreement in this case contained a bond clause, a very common “suspensive” clause giving the buyer an agreed period of time within which to obtain a bond, failing which the agreement would come to an end automatically.

- Bond clauses commonly specify a 30-day period from the date of the sale agreement, making it clear when exactly the period expires.

- The problem in this case was that the bond clause was worded somewhat differently, no doubt because of an issue with unlawful occupants on the property.

- This clause gave the buyer 30 days, not from the date of the sale, but from the date on which she was given “sole beneficial occupation”.

- For a variety of reasons the transfer was delayed for four years, and the seller – now keen to get out of the sale because she had decided that the agreed price was too low – argued that the agreement had fallen away automatically. The bond clause period, she said, expired 30 days after the buyer took possession and occupation (the date of the sale) and the buyer’s failure to get her bond within that period put an end to the sale.

- The buyer on the other hand argued that the 30 days never started running at all, because even four years later there were still unlawful occupants on the property (the sale agreement authorised her to evict the occupants at her own cost, and she hadn’t done so).

- The Court held that the sale agreement distinguished between “possession” and “occupation” – which had both been given to the buyer immediately on signature of the sale agreement – and “sole beneficial occupation”. In the context of this agreement, held the Court, “sole beneficial occupation” meant that the buyer, “to the exclusion of all others, was to enjoy the benefit of occupation of the property pending transfer.”

- Although the buyer had indeed been given “possession” and “occupation” four years ago, she had never been given “sole beneficial occupation”. The 30-day period had never started running and the seller is bound by the sale agreement.

For want of a well-drawn bond clause…

Badly drawn bond clauses have been the downfall of many a seller and many a buyer in the past. In this case the seller is not only stuck with an unsatisfactory sale price, she also loses four years’ worth of income because the buyer is not liable for occupational interest until sole beneficial occupation is given. Plus of course the seller must now pay all the legal costs.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Here’s how to expand your mind’s abilities to get more done”

Boosting productivity is one of the fundamentals of success in both our personal and our professional lives.

“Get more done in less time” is the perfect strategy for making the most of everything we do, but how to go about it in practice? Our challenge in the Online Age is being swamped by productivity tips of every shape and size – so how do we cut through the noise and get to the nub of what will work for us and what won’t?

For a quick and easy summary of three tried-and-tested ideas on cutting through to the essentials, read “3 Things the Most Productive People Do Every Day” on the Barking Up the Wrong Tree website.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

A recent High Court decision saw both a sectional title unit owner and his cupboard contractor held liable for damages suffered by an 11-year-old boy electrocuted by a communal tap. The complex’s body corporate and an electrician were also sued but escaped liability.

The reasons given by the Court for these contrasting outcomes provide valuable lessons for property owners, contractors, and bodies corporate.

Electrocuted when he turned on a tap

- You don’t expect to be electrocuted when you turn on a tap, but that is what happened to an unfortunate boy, aged 11, who had offered to wash his mother’s car in a residential complex.

- When he touched a communal tap to fill up a bucket of water he was electrocuted and unable to remove his hand for 1 to 2 minutes. Fortunately the tenant of the unit which was the source of the electric current arrived home in time to switch off the electricity so that the boy could be rescued.

- He was rushed to hospital with serious injuries and his mother sued all the role-players for more than R3m in damages on his behalf.

- To simplify as much as possible some very complicated facts, a cupboard contractor had been brought in to do work in the unit by the owner’s agent/employee at the request of a tenant. The contractor employed two workers who caused the initial problem by drilling through a wall and damaging the electrical insulation.

- The owner’s agent then contracted an electrician to fix the problem, but he only compounded the danger by bungling the repair job and leaving the plumbing live.

- The tenant, shocked (electrically, presumably also figuratively) when she turned on taps in the unit, switched off the electricity and reported the danger to the agent. Unfortunately the two workers, in her absence the next day, switched it on again – thus creating anew the dangerous situation that later that day led to the boy’s electrocution.

Let’s have a look at some of the legal principles that led the Court to its decision in regard to each of the role-players –

Your agent or employee doesn’t tell you of a dangerous situation – are you liable?

There was a dispute over whether the owner’s “agent” was legally an agent or an employee, and whether or not he had told the owner of the dangerous situation. But it made no difference, held the Court – the “agent’s” knowledge of the dangerous situation in the unit was attributed to the owner because (1) he had acquired that knowledge in the course of his employment, and (2) in the circumstances he had a duty to report it to the owner.

Make sure your agents and employees are trustworthy enough to tell you about any dangerous situations in your property!

Are you liable for your contractor’s negligence?

Clearly the workers employed by the contractor had caused the dangerous situation, firstly by damaging the electrical insulation and secondly by turning the electricity back on knowing of the danger. The contractor was accordingly liable, but what about the property owner who had employed him?

Our law is that you are not automatically liable for your contractor’s negligence, but you must “exercise that degree of care that the circumstances demand”. On the basis that “It is the principal, who selects his agent and represents him as a trustworthy person, and not the other party to a contract who has no say in the selection, who bears the risk……” (emphasis supplied), the Court found both the contractor and the unit’s owner liable for “the negligent omissions and/or acts on the part of their agents/employees.”

In any event both the “agent’s” inaction and the actions of the two workers “jointly contributed to the cause of the electrocution of the minor. Had either acted as they ought to have, the minor would not have been electrocuted.”

You are at risk for the conduct of any contractors and employees on your property, so again make sure they are trustworthy!

When is a body corporate liable?

A body corporate is as much at risk of being sued as any individual owner in a case such as this – it was presumably sued in this matter on the basis that the tap in question was a “communal” one and therefore under its control.

Its security officers had become aware of the situation when they queried the presence of the workers in the complex. However the claim against it failed as the evidence was that the child’s electrocution “was unforeseeable as far as it [the body corporate] was concerned. It had no duty to do anything while it was unaware of the danger posed. There had never been any problem with the electrical installation and it follows that what occurred was not reasonably foreseeable to it. Immediately the dangerous situation was brought to its attention it acted immediately.”

As a body corporate, take all reasonable steps to prevent dangerous situations arising in the complex in the first place, and take immediate action to rectify any that come to your notice!

What about the negligent electrician and the “chain of causation”?

Our law is that you are only liable if there is a “chain of causation” between your negligence and the damage resulting. So you can sometimes escape liability if there is a new “intervening cause” that interrupts that chain of causation.

In this case, the electrician’s failure to do the repairs properly was held to have been a “direct cause” of the incident. But his bacon was saved by the fact that the two workers, in switching the electricity back on, knew they were creating a dangerous situation anew. This made it sufficiently “unusual”, “unexpected” and not “reasonably foreseeable” for there to be – from the electrician’s point of view – a new “intervening cause” which interrupted the “chain of causation” between his negligence and the electrocution. The claim against him failed accordingly.

Any break in the “chain of causation” may come to your rescue if you are sued. But don’t count on it!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Death is not the end. There remains the litigation over the estate.” (Ambrose Bierce)

Your will (“Last Will and Testament”) will always be the keystone of your estate planning, and a recent High Court decision sounds yet another warning to beware the “do your own will” concept. By not having his will drawn by a professional, a father inadvertently caused one of his children to be disqualified from inheriting her intended share, whilst her husband was disqualified from being appointed as executor.

Who is disqualified from inheriting?

Our law, in the form of the Wills Act, provides that no one (or their spouse) can receive “any benefit” under a will if –

- They signed it as a witness (unless it was also witnessed by two other competent people not receiving any benefit), or

- They signed it for the testator (even though in their presence and at their direction), or

- They wrote out the will or any part of it in their own handwriting.

“Any benefit” in this context means not just inheritance as an heir, but also appointment as executor, trustee or guardian.

A court can only allow such a person to inherit “if the court is satisfied that that person or his spouse did not defraud or unduly influence the testator in the execution of the will”. Importantly (as we shall see below), it is up to the heir to prove the absence of any fraud and undue influence.

As the Court put it: “This disqualification exists in order to prevent falsity and fraud, and to prevent ‘the exertion of undue influence over people in bad health or in feeble state of mind’. This is because the fact that someone who stands to benefit from the death of a testator in terms of a will, and who is involved in the drawing of the very will in which that benefit is declared, ineluctably invites speculation that he or she may have improperly influenced the testator in the framing of his final testament, more particularly so where the will is executed at a moment of crisis in the testator’s life.”

If the beneficiary would have inherited anyway under intestacy (i.e. if the deceased had not left any valid will at all) they may still inherit but no more than the value of their intestate share.

The facts of the family fight

- In poor health and realising he needed a will, the testator had asked a friend to help him draw one. The friend produced a typed will, in terms of which each of the testator’s three children (from two different marriages) received one third of his estate. In addition a son-in-law was appointed as executor.

- The will was, said the Court, “slightly unusual” in that it included a narrative on the father’s difficulties with his third wife, but the real problem (as it turned out) came from the fact that annexed to it was a four-page typed schedule of 69 assets with spaces against each of them for insertion of the name of the child to receive that asset. Critically, those names were filled in by hand by one of the daughters – on, she said, her father’s instructions.

- The will and schedule were properly signed and witnessed, and the father died five days later.

- As is regrettably all too common when a deceased leaves behind children from more than one marriage, a fight developed between them, with a claim that the schedule of assets did not reflect the father’s wishes through either fraud or undue influence.

- The end result (much bitter dispute over facts later) the Court held that the daughter who had completed the names on the schedule by hand was disqualified from inheriting any more than her share on intestacy, and her husband was disqualified from being appointed as executor.

The bottom line

All that dispute, uncertainty and legal cost could have been avoided had the father called in a competent professional to draw his will for him (preferably long before his illness struck). Don’t make the same mistake!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Where one of the parties wishes to be absolved either wholly or partially from an obligation or liability which would or could arise at common law under a contract of the kind which the parties intend to conclude, it is for that party to ensure that the extent to which he, she or it is to be absolved is plainly spelt out.” (Extract from judgment below)

Employee theft has been a headache for employers from the dawn of history, and no business should ignore the dangers it poses, particularly if your business handles third-party high value goods. Your chances of being sued if one of your employees steals a customer’s asset/s are high, the reason being of course the concept of “vicarious liability” – the legal rule that can make you generally liable for your employee’s actions.

Your best defence (other naturally than taking steps to stop light-fingered employees from stealing in the first place!) is the “exemption” or “disclaimer” clause. It can present a formidable obstacle to any customer (or their insurer) seeking to hold you liable, but it needs to be professionally drawn, unambiguous, and tailored to suit your particular industry, circumstances and contracts.

A recent Supreme Court of Appeal (SCA) decision illustrates –

The cargo thief who stole R4.5m worth of computers

A customer imported by air freight some R4.5m worth of computers and accessories, and contracted a clearing and forwarding agent to receive and forward them to the customer from the SAA cargo warehouse.

The agent’s employee, armed with his “identity verification system” card and the necessary custom release documents, collected and loaded the consignment into an unmarked truck, signed the cargo delivery slip, and disappeared with his loot.

Sued by the customer for its losses, the agent relied on the exemption clauses in its Standard Trading Terms and Conditions. These clauses were comprehensive and widely worded which, as we shall see below, proved central to the agent’s legal victory here.

On appeal the SCA dismissed the claim against the agent on the basis that it had been able to prove that its liability was excluded by the exemption clauses. Let’s see how it achieved that…

Employers – can you be sued?

Without an enforceable exemption clause in its standard contract, the employer in this case would have been liable for R4.5m (plus substantial legal costs).

Critically, the forwarding agent’s success here resulted from the Court’s interpretation of the wording of these particular clauses, in the context of this particular contract, and in the particular circumstances of this matter. Any ambiguity in meaning would have been fatal for it, and it was particularly assisted in this case by the fact that it had made special provision in the contract for “goods requiring special arrangements”. In other words, make sure your contracts all contain unambiguously worded exemption clauses tailored to your specific industry and circumstances.

Customers – can you sue?

Read and understand the contracts you sign, follow any requirements applying to specified or “valuable” goods, and take professional advice if you are unhappy with any of the terms. The reality is however that few service providers will be prepared to compromise on exemption clauses, which leaves you vulnerable unless you have the right type of insurance cover – check upfront!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews