“Someone’s sitting in the shade today because someone planted a tree a long time ago” (Warren Buffett)

Whilst the first and most important step in your estate planning is always to have in place a professionally drawn and regularly updated will (“Last Will and Testament”), there is another aspect which demands your urgent attention, particularly now…

What will your family live on while an executor is being appointed?

It is essential that you provide for your family’s ongoing financial needs during the process of winding up your estate, because all your bank accounts will be frozen as soon as the bank learns of your death, pensions and the like take time to transfer across, and your assets generally will be tied up in your estate and inaccessible to your loved ones.

The executor of your deceased estate does have the power, provided of course that your estate is solvent and has sufficient funds, to release money to your dependents and to make advances to your heirs – but only after being formally appointed. Which brings us to…

Delays in the Master’s Office are getting worse

No matter how professional and efficient your nominated executor may be, he or she is powerless to act until the local Master of the High Court (“Master’s Office”) issues the necessary “Letters of Executorship” (“Letters of Authority” in smaller estates), so applying for them is always a priority for those nominated.

The issuing process has never been a quick one, but delays have worsened substantially in the past few years with media stories abounding of major problems in Master’s Offices around the country and reports of “unprecedented backlogs” and “an almost total breakdown in services”.

The recent ransomware attack on the Department of Justice and Constitutional Development is just the latest in a litany of woes afflicting these offices – pandemic-related lockdowns, office closures and remote working, staff shortages and a surge in the number of deaths, a Special Investigating Unit investigation into allegations of misconduct and corruption in some offices (with two officials suspended so far and many others reportedly in the firing line) – the list goes on.

Nominated executors are complaining of inordinate delays in being appointed, and of extreme difficulty in communicating with Master’s Office officials by phone, email or even by personal office visits.

Here’s how to fund your loved ones in the interim

The bottom line is that you will leave your grieving family dealing with financial worries at the worst possible time if they have to wait for your chosen executor to be appointed.

You need to find another way of giving them immediate access to funds, enough to cover their living expenses and any new expenses like funeral costs.

There are a few tried and tested ways of providing this cash flow, with separate bank accounts and investments being probably the simplest and most quickly accessible options. Consider also other assets in family members’ own names, family trusts, businesses held in entities that will survive your death, and so on. Another popular choice is life/endowment policies, TFSAs (Tax Free Savings Accounts) based on a life product, living annuities and the like – be sure to nominate beneficiaries for these products otherwise they will fall into your estate and not be paid out to your loved ones direct. Be certain that your loved ones know what measures you have taken and how they can access these funds quickly and easily.

Your own situation will be unique and you need to structure everything correctly, so there is no substitute for professional advice here!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“A man who procrastinates in his choosing will inevitably have his choice made for him by circumstance.” (Hunter S. Thompson)

Since 2005 businesses have been repeatedly told “get your PAIA (Promotion of Access to Information Act) manual sorted now, the deadline is approaching”. And every 5 years since then, those (mostly smaller) businesses temporarily exempted from lodging manuals have been given yet another extension – usually at the very last minute.

“Crying Wolf” again?

With government “Crying Wolf” so often, small business owners can certainly be forgiven for treating this whole process with a great deal of scepticism. Perhaps though this deadline is one to take seriously, particularly since the related POPIA (Protection of Personal Information Act) is now fully in place and new PAIA Regulations have been promulgated to tie in with POPIA.

What businesses are currently exempt?

PAIA itself requires all public and private bodies to prepare, lodge and publish (including on any website you have) a PAIA information manual. Every business operation, no matter how small, falls into that net – the definition of “private body” includes any person or partnership who carries on or has carried on “any trade, business or profession”, together with any “former or existing juristic person” and political parties.

In other words, all businesses of all types and sizes must have a PAIA manual once the current exemption comes to an end.

You are probably currently exempt if you are a smaller business, specifically a “private body”, including any private company.

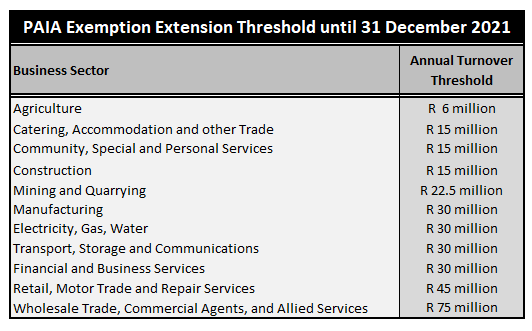

But the exemption does not apply to any non-private company, nor to any private company in any of the business sectors listed below with either –

- 50 or more employees, or

- An annual turnover of or above specific thresholds – see the table below for details.

Do your Manual now anyway!

Even if the deadline is once again extended, you will almost certainly still have to comply somewhere down the line, and at least by getting this done now you have got rid of one annoying little red tape item from your Action List. Procrastinating, as Hunter S Thompson pointed out, just means having the choice made for you down the line.

Prepare your PAIA manual now; if you already have one, update it regularly.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Our cellphones have, for most of us, become integrated into virtually every aspect of our lives.

Take a moment now to think of how much damage a cybercriminal, or an industrial spy, perhaps even a malicious stalker or vengeful ex-employee, could do both to you personally and to your business if they succeed in getting spyware onto your phone.

Concerned? Firstly be aware that “spyware on your cellphone” is a real threat, and then act immediately to protect yourself.

A good start is this guide to –

- What spyware is,

- What the warning signs of infection are, and

- How to remove it from your mobile devices

Read “How to find and remove spyware from your phone” on ZDNet.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“[The Ombud} has been given wide inquisitorial powers whereby such disputes can be resolved as informally and cheaply as possible by means of qualified conciliators and adjudicators, without the need for legal representation, save in certain limited circumstances.” (Extract from first judgment below)

If you have a dispute with anyone in a “Community Scheme” – sectional title, Homeowners Association (HOA) or the like – remember that your first port of call should be the CSOS (Community Schemes Ombud Service).

What disputes can the Ombud resolve?

Disputes are inevitable in any community situation, with sources of conflict ranging from noise issues to problem pets, common area usage disagreements, parking space complaints and so on – the list is endless. Another perennial battleground is owners fighting with administrators (normally a body corporate or Homeowners Association) over levies, rules and regulations, and the like.

The Ombud’s mandate here is wide, with the CSOS promising “affordable, reliable justice” via its conciliation and alternate dispute resolution process for anyone party to, or “materially affected by” any of a wide range of disputes including levy disputes, nuisance complaints, repairs and maintenance disputes, complex meetings, financial, governance and management issues, exclusive use rights and the like – the list is long and widely-worded.

How does it work?

Costs are low and the process is straightforward, with legal representation restricted to cases where the adjudicator and all parties agree to it or where the adjudicator decides that a party cannot deal with the adjudication without it. There are media reports of the CSOS struggling in practice to provide the quick and reliable service promised on its website, but all in all, it should generally be your first port of call. In fact the High Court has now warned that you will almost always have no choice in the matter.

You must approach the Ombud before you go to court, unless…

The High Court has now stated categorically that, whenever the CSOS has the power to adjudicate a dispute, you have to go that route first and can only go direct to court in exceptional circumstances –

- The scene in this first case is an inner-city 10 storey mixed-use sectional title scheme. The parties are on the one hand a group of loft owners unhappy with a new biometric security/access control system and with a new conduct rule limiting their right to lease out their loft apartments on a short-term basis; on the other, the body corporate trying to resolve security issues in the building with the new rules.

- The loft owners asked the High Court to intervene as a matter of urgency and were soundly defeated, with the Court ordering them to pay costs on the punitive attorney-and-client scale after finding that “…this is not only a matter which should not have been brought before this Court and should have been taken to the Ombud, but is also one which constitutes an abuse of process…”.

- As the Court put it: “…the statutory powers which an adjudicator has in terms of the Act are extremely wide and go beyond the powers which a court has in relation to neighbourly disputes and associations in terms of common law, not only insofar as their reach is concerned, but also in relation to their ambit. In numerous instances an adjudicator has an equity i.e. fairness-based power, not only to decide what is ‘reasonable’ in relation to the conduct of, or the decisions which have been taken by an association such as a body corporate of a sectional title scheme … but also to direct what should ‘reasonably’ be done in place thereof. A High Court does not have such powers.”

- Thus: “…where disputes pertaining to community schemes such as sectional title schemes fall within the ambit and purview of the CSOS Act, they are in the first instance to be referred to the Ombud for resolution in accordance with the conciliative and adjudicatory processes established by the Act, and a court is not only entitled to decline to entertain such matters as a forum of first instance, but may in fact be obliged to do so, save in exceptional circumstances…” (emphasis supplied).

- Exceptions, said the Court, would include challenges to the “constitutionality or legal validity or status of a particular statutory power or a provision in the Act” plus “in certain instances it is conceivable that the High Court may be approached in the first instance, as a review court.”

- Each case will be different so take full advice before deciding whether to approach the Ombud or go straight to the High Court.

Going direct to court when the Ombud has no jurisdiction

- Another recent High Court judgment concerned a sectional title scheme dispute in an industrial complex. After their unit was destroyed by fire, the unit’s owners claimed from the scheme’s insurers.

- The insurers repudiated the claim on the basis that they had, following a previous fire, suspended the scheme’s fire cover pending the filing of valid electrical and fire equipment certificates of compliance by all the owners of units in the scheme.

- The owners approached the Ombud, claiming some R480k from the body corporate for damage to the unit and lost rental on the basis that “the body corporate had negligently failed to comply with its statutory ‘duty of care’ to ensure that the buildings in the scheme were properly insured”.

- The CSOS adjudicator said he had no jurisdiction to hear such a matter, and the High Court agreed, holding that the claim was personal to the individual owner “and did not pertain to the scheme itself…”.

- Moreover “It was clearly not intended that the Ombud would have the power to adjudicate on delictual claims for damages, which involve weighty considerations pertaining to wrongfulness (which depend on prevailing societal norms and public policy) and fault, and the quantification and determination of the quantum of any damages which may have been sustained pursuant thereto, which are matters which are best left for judicial officers and Courts.”

Arrear levies – when can the Ombud help with collection?

Our courts have held that the Ombud can assist with the collection of arrear levies or contributions, but only where there is a dispute involved.

Thus (to quote from a 2017 High Court judgment): “If the claim for arrear levies or contributions is not disputed, for example if an owner simply ignores a demand for payment or simply refuses to pay, without disputing the amount of the claim or the proper determination of the levy, the Body Corporate can institute legal action in court to recover the arrear levies from the owner … If, on the other hand, the amount of the levy is disputed because it was not properly determined and this dispute is raised after the defaulter had received a demand, the appropriate forum for recovery of the levies would be the regional office of the Ombud service.”

The bottom line

To avoid any mis-steps here, seek professional advice before deciding when and how to take community scheme disputes to the Ombud.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The seriousness and gravity of offences involving racism and racial hatred cannot be over-emphasised. Employers are under a duty to provide a safe working environment and to protect all employees from harm, whether physical or emotional, whether they are black or white. An employer can be held liable for failure to take any action against its employees who are guilty of such conduct. South Africa is a country plagued by a history of racism and violence and social media plays a significant role in the incitement of racial hatred and violence. The power of such posts on social media inciting racial hatred cannot be undermined.” (Extract from judgment below)

Here’s yet another warning from our courts to tread with extreme care when posting anything online. Social media channels (particularly it seems Facebook) are favourite arenas for insults, threats and incitements to hatred and violence.

“Think before you post” is the only safe option here. Misusing social media unlawfully is dangerous for anyone and at any time – a damages claim for defamation or a subpoena from the Equality Court could be the least of an offender’s worries.

When it comes to employees, the spectre of summary dismissal will always loom large if any form of racism or other serious misconduct is involved.

A recent Labour Court decision illustrates –

Off duty, but still dismissed for a racist Facebook comment

- A “general worker” with 10 years’ service in a high-profile company with a multicultural workforce posted a comment on the Eyewitness News Facebook page that all white people must be killed (“Whites mz b all killed”) and was charged at a disciplinary enquiry with two offences –

- Making a racist comment on social media, and

- Thereby acting contrary to the interests of his employer.

- At the disciplinary enquiry, the employee denied that he had posted the Facebook comment and claimed that his Facebook page had been hacked.

- Found guilty on both charges, he referred a dispute to the CCMA (Commission for Conciliation, Mediation and Arbitration), alleging unfair dismissal. It was at this stage that he changed his story to admit that he had in fact made the offending Facebook post.

- The commissioner ultimately upheld the dismissal as both substantively and procedurally fair, a decision taken on review by the employee to the Labour Court.

- The Labour Court dismissed the review application, finding firstly that even if the employer had had no disciplinary code in place “any employee would know that it was an extremely serious offence for a member of one race group to call for the killing of all members of another race group.” In any event, the employee had in fact been trained in the employer’s disciplinary code, and that prescribed dismissal for the offence of racism.

- The employer had a duty to protect its employees from racist misconduct and had “consistently charged people for offences involving racism. The last employee that had been dismissed for racism was charged and dismissed for using the “K” word.”

- It was irrelevant that the employee had made the Facebook post outside his workplace and outside his working hours as “it is the attitude that persists which, when on duty, affects the employment relationship.”

- He had also exposed his employer to a risk of reputational damage and had acted contrary to its interests as per the second disciplinary charge.

- The employee’s dismissal stands.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“… he did not think that he was binding himself ‘to all sorts of fine print that I can’t even read’.” (Extract from judgment below, describing evidence given by the customer during the trial)

For suppliers of goods or services, incorporating a strong, clearly worded exemption clause (a clause excluding or restricting your liability to the customer) into your contracts is an essential part of risk management. Just be aware of the restrictions that our laws place on them.

As a recent Supreme Court of Appeal (SCA) judgment shows, your first hurdle in enforcing a disputed exemption clause could be to convince a court that the consumer did in fact contract on the basis of that condition –

“In fine print” and “not conspicuously legible” – so not part of the contract

- A shipping company agreed to transport from America to South Africa an overhauled aircraft engine.

- It failed to make delivery to its customer after the engine was destroyed in transit in the U.S. The shipment had not been insured, and the shippers told the customer that according to their terms and conditions for ocean freight shipments, they were only liable to pay US $500 (about R6,000 at the time) per shipment.

- The customer was having none of that and sued the shipper in the High Court for the engine’s full replacement value of R386,140-30. The shipper relied on a series of wide-ranging clauses, incorporated in its standard trading conditions, which limited its liability.

- The High Court ordered the shipper to pay up on the basis of consumer protections contained in the Consumer Protection Act (CPA) which make it compulsory to word exemption clauses “in plain language” and to draw them “to the attention of the consumer … in a conspicuous manner…”.

- The shipper appealed to the SCA, which, in dismissing the appeal, held that it was not necessary to consider the CPA question because the customer hadn’t contracted on the basis of the standard trading conditions in the first place. The customer regarded his contract as formed by an initial exchange of emails, and only afterwards was he asked to sign a credit application in order to open an account. As he did not require credit, he regarded all that as merely a matter of formality to capture his details and allocate him an account number.

- The shipper, held the Court, did not explain to the customer that the credit application contained provisions that excluded or limited the shipper’s liability for loss or damage. “Furthermore, the standard trading conditions and the relevant clauses which [the shipper] seeks to rely on appear in fine print, and are not conspicuously legible. They appear on the second and third pages of the credit application, which can only be read with extreme difficulty and concentrated effort. Importantly the credit application was sent without the conditions being attached and were described by [the shipper] as needing to be completed so that ‘we can start the process’.” (Emphasis supplied).

- The shipper must pay up in full, plus interest and (no doubt substantial) costs.

As a supplier, if you want your exemption clause to be accepted in court …

In addition to a general inclination by our courts to consider the principles of ubuntu, fairness, good faith and public policy when interpreting contracts, bear in mind the CPA’s requirements (summarised above) and the need to incorporate your exemption clause clearly and unambiguously into your contract before it is concluded.

As a consumer, read the fine print!

“Education is when you read the fine print. Experience is what you get if you don’t.” (Pete Seeger)

Although, as is clear from the above, you might be able to circumvent an exemption clause, our law will generally hold you to all the terms and conditions of your agreements. The safest course therefore will always be to heed the old legal principle “caveat subscriptor” (“let the signer beware”), so read the fine print, and in any doubt take professional advice before you sign anything!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Whilst the Act no longer uses the term “illegitimate child” this is implied by the reference to so-called children “born out of wedlock” which continues to perpetuate the common law distinction between so-called “legitimate” and “illegitimate” children. This reference is a stark reminder that we, as a nation, are still grappling with outmoded legal terminology which goes to the core of dignity and equality, not only for the child but also the unmarried father, and indeed the unmarried mother as well.” (Extract from judgment below)

New parents, married or not, are obliged by the Births and Deaths Registration Act (“the Act”) to register their child’s birth with Home Affairs within 30 days.

However in regard to the actual process of giving this “notice of birth”, the Act has always distinguished between married and unmarried parents. In particular, unmarried fathers have until now been unable to register the child under their own surname except with the mother’s permission. Given the importance – to the child, to the parents and to their wider families – of what surname is entered into the population register, it is perhaps no surprise that the validity of the Act’s differential treatment of married and unmarried parents has been challenged in the Constitutional Court.

The Court’s decision is that the relevant part of the Act is unconstitutional and is struck down. The Court: “Children born to parents outside the marital bond are blameless, yet the retention of section 10 of the Act serves to harm children born outside of wedlock. The status of being born out of wedlock, in effect, penalises the child and the unmarried father, and of course the mother too. This differential treatment of children born out of wedlock is invidious and unconstitutional. This differential treatment cannot be justified.”

The practical effect of the ruling, and the parents’ 3 surname choices

From now on, unmarried parents are in exactly the same position as married parents, so that either of them can give the notice of birth under –

- The father’s surname, or

- The mother’s surname, or

- The surnames of both the father and mother joined together as a double-barrelled surname.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Here’s some really good news for all of us motorists dreading the annual challenge of queuing to renew our car licences.

The Road Traffic Management Corporation has launched an online payment gateway allowing us to register, renew, and pay for our licence discs on the NaTIS online platform. Read “New online car licence disc renewal portal launched” on MyBroadband for details and instructions on how to use this new facility. Read to the end of the article for news of a planned SA Post Office smartphone app, and FNB’s existing online renewal and delivery service.

Note: This does not relate to driver’s licence cards, for which an online renewal system is planned but not yet finalised.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“A great deal is at stake in the transfer of fixed property. It is generally the largest single asset that a person owns and the transaction for the purchase or sale of a fixed property is probably the most important contract undertaken by individuals” (Law Society of South Africa)

For many of us, our home is our most important asset so when it comes time for us to sell, do everything possible to ensure that your interests are fully protected, that the sale goes through quickly and smoothly, and that you are paid without unnecessary delay.

Appointing the right conveyancer is key here. Let’s have a look at the “Why, Who, How and When” of it…

Why do I need a conveyancing attorney?

Legal ownership in “immovable” or “fixed” property (that is, land and permanent attachments such as buildings) can only be transferred from seller to buyer through a formal registration process in the Deeds Office. This is carried out by specialist attorneys who have been admitted to practice as conveyancers.

Who appoints the conveyancer, and how?

As the seller, it is your right to choose which conveyancer will carry out the transfer.

The agreement of sale (it may be called an “Offer to Purchase”, “Deed of Sale” or similar) should contain a clause specifying the conveyancing (or “transferring”) attorney. Make sure you fill in your chosen attorney’s name and details in the space provided, and do not allow anyone else to dictate to you who to use!

You may occasionally come across an offeror/buyer wanting to appoint their own attorney for one reason or another, perhaps with the argument that because they are paying the transfer costs (which include the conveyancer’s fees), the choice should be theirs. But the fact is that you carry more risk, and there is nothing to stop the buyer from employing another attorney to monitor the transfer on their behalf if they really feel this necessary.

Bottom line – stick to your guns! This is your house at stake, so the choice is yours, and yours alone.

When should I bring my attorney into the sale process?

Ideally, from the very start. When you first decide to sell, you will find it invaluable to have your attorney’s advice on how to go about it, whether you should speak to an estate agency, how best to market your property, what pitfalls to avoid and so on.

When it comes to the agreement of sale itself, a myriad of things can go wrong if the contract isn’t professionally drawn to be clear, concise, legally enforceable and configured to protect your interests. So if you are presented with an offer or agreement drawn by someone else, take legal advice before you agree to anything!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“… it cannot be said as the applicant suggests that the loss of citizenship takes place without notice and automatically as the citizen in that position has proper notice through the structure of the section of both the opportunity to seek consent to hold dual citizenship and the consequences of acquiring a second citizenship without obtaining such permission. It therefore is not a secret provision but one that every citizen who voluntarily seeks to acquire another citizenship should ordinarily acquaint themselves with” (extract from judgment below)

Note: Many South Africans who need to be aware of this risk will be overseas and/or may not have heard of the High Court decision we discuss below. If you know of any such person, please consider forwarding this to them as soon as possible.

A recent High Court judgment has confirmed that you will lose your South African citizenship if you apply for citizenship of any other country without prior Ministerial permission.

It is irrelevant whether you are South African by birth or not. It is also irrelevant why you want to acquire dual citizenship – perhaps you are living/working overseas, perhaps you want a second passport just to make travelling easier, perhaps you have financial reasons.

How and why you lose your South African citizenship

Dual citizenship itself is allowed, but our Citizenship Act provides that if “by some voluntary and formal act” you acquire citizenship or nationality of another country, you are deprived of your South African citizenship. And Home Affairs is interpreting that to mean that you have voluntarily given up your South African citizenship by your own “formal act” of applying for foreign citizenship.

You are exempt only if …

This loss of citizenship does not apply to –

- Minors (under 18 years of age) and

- Acquisition of another country’s citizenship by marriage.

How to retain your South African citizenship

The good news is that you can apply through Home Affairs for authority to retain your SA citizenship – but your application must be approved before you acquire your second citizenship.

The bad news is that it takes time, so don’t leave it to the last minute! Even before the pandemic, processing time was given as “3 to 6 months” and media reports suggest that delays are now much longer, although perhaps the publicity surrounding the High Court case in question will assist in improving the situation. If you are overseas, you should find the necessary forms and instructions on your local SA Embassy/Mission/Consulate website.

You’ve lost your citizenship – what now?

This is very much second prize, but you can still apply to get your citizenship back –

- If you were a citizen by birth or descent you can apply for reinstatement only if you have returned to, or are living in, South Africa permanently (you still have permanent residence, you just aren’t a citizen).

- If you were a citizen by naturalisation, you must re-apply for permanent residence or apply for exemption thereof, before you can be considered for resumption of citizenship.

- If all else fails, consider taking the legal route. As we discuss below, the High Court has recently held that the relevant provisions of the Citizenship Act pass Constitutional muster, but there is talk of a possible appeal.

High Court: Choose how important your citizenship is to you, and know the law

There has always been speculation that this section of the Citizenship Act could be held to be unconstitutional. However, in rejecting a recent application to that effect by the Democratic Alliance, the High Court has confirmed that it passes constitutional muster and is not “irrational”.

The High Court’s reasoning was that “It is ultimately a matter of personal choice what weight each of us attaches to the idea of our citizenship”, and that this is not a case of automatic loss of citizenship without notice but rather it “is really about personal and individual choices people make about their future and often choices come with consequences.”

The section in question, held the Court, is “not a secret provision but one that every citizen who voluntarily seeks to acquire another citizenship should ordinarily acquaint themselves with … while it may be arguable that citizens cannot be expected to know every feature of the law, those citizens involved in migration and relocation to other countries with the possibility of acquiring citizenship there must surely be expected to acquaint themselves with the law in that area of activity they are involved in.”

There is talk of an appeal but for now at least, if you have already lost your citizenship your options are limited to those set out above.

P.S. Never let your SA passport lapse!

Although you can travel freely around the world on your second passport, you must enter and depart from South Africa on your valid SA passport. Keep renewing it!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews