“In common law, everyone is in general permitted to use their property for any purpose they choose, provided that the use of the property should not intrude unreasonably on the use and enjoyment by the neighbours of their properties” (extract from the “gym case” below)

Consider this unhappy scenario – you buy your dream home (or perhaps new business premises), only to find that you are afflicted with the noisiest and most unreasonable neighbours you have ever encountered. A friendly approach to them produces no result. Can you get a court order to stop the noise?

Let’s address that question with reference to two recent court cases, but first –

What must you prove?

To get a “final interdict” (in this instance a court order compelling the offenders to put an end to the noise) you have to prove three things –

- “A clear right”,

- “An injury actually committed or reasonably apprehended”, and

- “The absence of similar protection by any other ordinary remedy” (in other words, you must show that you have no adequate alternative remedy available to you – an important aspect, as we shall see below).

In the suburbs: The pastor v the puppy daycare home business

“…the courts apply a reasonableness standard, which entails a balancing of the mutual and reciprocal rights and obligations of neighbours” (extract from the judgment below)

The scene in this first case is a suburban residential area in Cape Town’s Northern Suburbs.

- A pastor, needing “a peaceful environment to write, research, study and counsel his congregants”, applied to the High Court for an interdict against his neighbours. The problem was their home business in the form of a puppy daycare centre, operating in their garden and offering supervision, structured playtime, potty training, basic training, socialisation and so on for up to 17 dogs at a time.

- The complaint centered on barking on the property, triggering “a cacophony of barking from all the dogs in the neighbourhood” – starting at 6.30 am (Monday to Saturday) until 6 pm. This, said the pastor, was “disturbing and disruptive to the peaceful enjoyment of his property and to his daily activities”, plus it had seriously affected the value of his property.

- Before buying the property he had viewed it over a weekend when there was no noise, and, because it was important to him, had specifically asked the previous owner about whether there was a barking problem in the neighbourhood.

- After fruitless discussions with the neighbours, he reported them to the municipal authorities (the City of Cape Town), lodging complaints for almost 4 years, resulting only in the issue of a compliance notice which the City failed to enforce, and a failed attempt at prosecution.

- In the High Court the complainant’s attack relied not only on common law “nuisance law” but also on alleged contraventions of the Western Cape Noise Control Regulations (all local authorities have power to make such regulations in terms of National Regulations), the City’s Development Management Scheme (with its restrictions on home business activities) and Animal By-Laws.

- The puppy daycare business raised a series of defences to these lines of attack, and disputed many of the complainant’s factual allegations, but in the end result the Court ordered the business to stop operating immediately. The business activity, said the Court, was “abnormal use” of a residential property, and “While such noise may be bearable in a busy City, where there is a lot of activity, such as large volumes of traffic, the constant movement of people and crowds and noise created by businesses, it would definitely disturb the peace and serenity of a quiet neighbourhood where such noises are not expected, and to which the applicant is entitled.” (Emphasis supplied).

In the city: the multi-storey building and the noisy gym

“…What constitutes reasonable usage in any given case is dependent on various factors, including the general character of the area in question – persons living and working in an urban area would, for example, reasonably be expected, in general, to be more forbearing about a higher level of noise intrusion into their lives than neighbours living in a rural housing estate” (extract from the case below)

We move now to the second case, also in Cape Town but this time in the City Centre.

- The owners of a property in a multi-storey building in the centre of Cape Town (a married couple living there and an attorney running a law practice in it) approached the High Court for an interdict against the neighbouring gym on the grounds of a substantial noise nuisance. The married couple’s bedroom window is just over a metre away from the window and balcony of the gym.

- The gym’s premises are zoned for commercial use, and there was no dispute that the area was subject to “substantial traffic noise”, but the complaints centered on allegations that the gym produced “loud techno/dance music with a strong beat” and microphone-amplified voice instructions to attendees at gym classes – at times ranging from 6 am to 6.45 pm.

- Many of the facts of the matter were, as is common in such bitterly fought matters, in dispute, and ultimately the Court declined to grant the interdict partially on the grounds of unresolved disputes of fact. Clearly the fact that the area was subject to considerable levels of “inner-city noise” anyway played a part, but the deciding factor seems to have been the Court’s finding that the complainants had declined the neighbour’s offer to follow the processes of the local Noise Control Regulations, which the Court held to provide an “adequate alternative remedy”.

- Moral of this story – don’t expect too much peace and quiet in a city centre, and exhaust all alternative remedies before asking for an interdict!

Property buyers – do your “noise risk” homework upfront!

Which leads us to a general note of caution to anyone about to buy a property – prevention being as ever a lot better than cure, investigate and understand the potential for “noisy neighbours” disrupting your peace and quiet before putting in your offer.

For example, the pastor in the puppy case took at face value the seller’s reassurances about excessive barking in the neighbourhood – he could perhaps have saved himself 5 years of stress and trouble had he been a bit more cynical and returned to the neighbourhood at various times during the week just to check.

And bear in mind that what may be considered a totally unreasonable noise level in one context could be considered quite acceptable in another. As the Court in the gym case put it: “…the applicants cannot expect the quiet serenity of the suburbs while living in the inner-city, which comprises a mix of commercial and residential properties, and particularly having purchased a property that is immediately adjacent to a commercially-zoned property.” (Emphasis supplied).

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Creditors have better memories than debtors” (Benjamin Franklin)

In these hard times of pandemic and economically destructive unrest, an unfortunate number of businesses face collapse, and many will opt for the “first aid for companies” option of business rescue.

Creditors coming out of that process with a shortfall (only the luckiest creditors are likely to emerge with full settlement) will naturally look to any personal suretyships they hold to cover that shortfall.

A recent SCA (Supreme Court of Appeal) decision has brought welcome clarity to the question of whether – and in what circumstances – such personal suretyships will survive the business rescue process.

Both directors and creditors need to understand the outcome, and to act accordingly.

Sued for R6m, a CEO’s defence crumbles

- A company CEO (Chief Executive Officer) signed a personal suretyship in favour of a creditor supplying the company with petroleum products.

- When the company fell upon hard times it was placed into business rescue. Eventually a business rescue plan was adopted, the rescue process was terminated, and the creditor sued the CEO for the shortfall on its claim of just over R6m.

- The CEO’s main defence was that his liability as surety was an “accessory obligation” – in other words, if the creditor’s claim against the principal debtor (the company) fell away, he should be released from his liability as surety.

- But, held the Court, although a principal debtor’s discharge from liability does indeed ordinarily release the surety, our law allows the creditor and the surety to agree otherwise.

- And the suretyship agreement in this case did just that. It contained “unobjectionable” and “standard” terms which included a specific agreement by the surety that he would remain liable even if the creditor “compounded with” the company by accepting a reduced amount in settlement of its claim. Nor was there any mention in the business rescue plan of its effect on creditor claims against sureties (it could, for example, have provided specifically for sureties to remain on the hook, or to be released). But the deciding factor remained that the wording of the suretyship was such that the creditor did not abandon its claim against the surety by supporting the business rescue plan.

- Bottom line – the CEO goes down over R6m, and the creditor has another shot at emerging unscathed from the mess.

Heed these lessons from the judgment!

The SCA in its judgment undertook a comprehensive interpretation of the terms of the deed of suretyship, of the business rescue plan, and of the relevant legislation. Although the detail will be of more interest to lawyers and academics than it will be to the average director or creditor, it did bring welcome clarity to an issue of great practical importance, and the valuable lessons therein should be heeded –

Directors: As always, think twice before signing any personal suretyship, and if you absolutely have no alternative, at least understand fully what you are letting yourself in for both legally and practically. Equally, ensure that the business rescue plan lets you fully off the hook as regards any possible personal liability; you may be advised to go further and have a separate release agreement with any creditor/s holding your surety. Although not directly relevant to this article, think also of managing any risk of personal liability beyond suretyship, such as allegations of reckless trading and the like.

Creditors: You on the other hand should always try for watertight and upfront suretyships from directors and others with attachable assets (again not directly relevant to this article, but also take whatever security you can over company assets such as debtors, fixed property etc). And when it comes to the business rescue plan, make sure that it leaves your claim against sureties unaffected.

Upfront professional advice and assistance is a real no-brainer here!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Creativity is the key to success” (Abdul Kalam)

It’s hard to think of a successful entrepreneur who isn’t at heart creative. Creativity comes with the territory, and anything you can do to increase it has got to be good for your bottom line.

The good news is that you can train yourself to maximise your creativity. First off take “The Divergent Association Task” here – it measures your creativity in under 4 minutes. Then move on to HuffPost’s 5 Creativity-building tips in “Yes, You Can Train Yourself to Be More Creative. Here’s How” here.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“There is never a wrong time to buy the right home” (Anon)

You find the house of your dreams, agree on the price and get ready to put pen to paper. The house is in the name of a company, and you are offered a choice – either buy the house out of the company or take over the company (which owns the house and nothing else) by buying the shares and thus avoid the delay and cost of a normal property transfer and registration in the Deeds Office.

What should you do?There are a host of both practical and legal factors to consider before deciding. Holding property in a company can come with significant advantages, but there can also be major disadvantages, so professional advice specific to your own circumstances is a no-brainer here.

Some of the many factors you should consider are –

- Tax and estate planning considerations. These are complex and no two cases will be identical, but consider the higher capital gains tax rates payable by companies (and the annual exclusion and “primary residence exclusion” of R2m for individuals), the differential income tax rates, possible VAT considerations, your own estate planning circumstances (including the estate duty angle) and the like.

- Asset protection. Particularly if you run your own business or are in a profession at significant risk of litigation, it may be important to you to protect your major assets (like your house) from possible attack by creditors. Any assets held in your own name will be a natural target if you run into financial problems, whilst those held in another entity like a company or trust will generally be much harder to attack. Complicated multi-level structures such as having a trust owning your company’s shares have generally fallen out of favour for a variety of reasons, but you may still be advised to consider one in your particular situation.

- Joint ownership. Joint ownership of property comes with its own set of risks and issues, and depending on your needs you might be advised to address them with a company/shareholder structure.

- Costs and simplicity. Running a company comes with extra costs (accounting/auditing, statutory costs etc), formalities and responsibilities, getting a bond in your own name is likely to be a simpler process than taking it in a company, and so on.

- The hidden risks. When you buy a company’s shares you get the company as it is, with all its assets and liabilities. If the seller is in any way unreliable, you could find yourself losing the house to an undisclosed company liability that suddenly crawls out of the woodwork. Suretyships are a particular danger here – there is no central register of suretyships you can refer to, and it is common for groups of companies and other entities in particular to sign cross-suretyships without necessarily keeping a record of them all. These are risks that can be largely managed with proper advice and due diligence, but a residual whiff of doubt is inevitable.

- Other factors. There will be many other aspects to consider, depending on your circumstances and needs, and on the company in question.

Transfer duty – you pay it either way!

As a buyer you can never lose sight of all the costs you will incur in buying a house, and the “big one” is normally transfer duty. It’s essentially a government tax, payable by you as buyer (unless the property sale is subject to VAT), and it can be a lot of money.

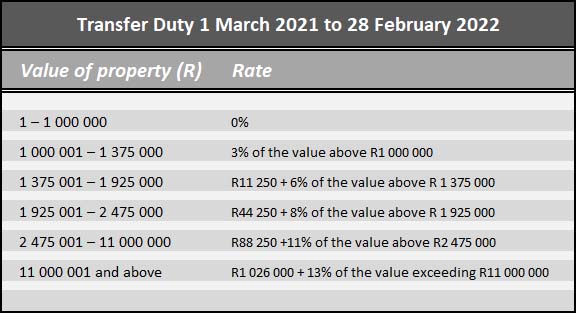

Do not however fall into the old (and surprisingly still-common) trap of thinking that by buying the company you avoid paying transfer duty. That was indeed a commonly used loophole in decades past and it is still sometimes referred to. But in reality that all changed many years ago, and (subject to what is said below) you should budget to pay transfer duty as set out in this table –

Source: SARS “Budget Tax Guide 2021”

So for example if you buy a house for R3m you will pay R146k in transfer duty. Or R916k on a R10m house. Finding a way to avoid or reduce such a cost is an attractive proposition, and indeed until 2002 it was a common way for buyers and sellers to save transfer duty and to instead pay only ¼% “Securities Transfer Tax” – a huge saving.

That loophole closed however many years ago – on 13 December 2002 to be precise – and since then the sale of shares in a “residential property company” (a company with over 50% of its asset value in residential property) attracts transfer duty on the “fair value” of the property. No savings there!

What about “buying” a property-owning trust?

Similarly, before 2002 a common transfer duty avoidance strategy was to hold property in a trust, then to “sell” the trust to a purchaser by substituting him/her as a beneficiary of that trust. That loophole was also closed in respect of beneficiaries holding “contingent interests” in the property – the situation here is a bit more complicated than it is with companies as there are various types of trust you could be dealing with, so specialist advice is essential.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The clean break principle after divorce has found resonance with our courts for many years. The aim of this principle is to ensure that the parties become financially independent of each other as soon as possible after divorce.” (Extract from judgment below)

Our courts always prioritise the interests of children in any marital breakup, and child maintenance orders are accordingly tailored to ensure that both parents honour their obligations to support their children financially – to the extent that each spouse is able to do so, and for so long as is necessary.

Spousal maintenance on the other hand requires a more delicate balancing act. In a nutshell, spouses have a “reciprocal duty” to support each other during the marriage, and although that duty ends when the marriage ends, courts still have a wide discretion to order either “permanent” or “rehabilitative” maintenance of the financially weaker spouse by the financially stronger spouse.

Let’s have a look at a good example of how this discretion is applied in practice –

A bitter divorce and a claim for “permanent” maintenance

- A couple were married “out of community of property with accrual”.

- Their eventual divorce action required the Court to adjudicate a litany of bitter disputes, allegations and counter-allegations of misconduct and abuse.

- Whilst for our purposes we’ll concentrate on how the Court addressed the wife’s claim for “permanent maintenance” and the husband’s (reluctant) counter-offer of “rehabilitative maintenance” for a limited period of time, it is important to note that the maintenance issue was decided against the background of the other financial benefits awarded to the wife. She received 50% of the “accrual” in the estate, including a house, pension, and annuities – i.e. she did leave the marriage with a capital sum of money.

- The wife had previously been granted an interim order of maintenance of R6,500 p.m. “pendente lite” (“pending the litigation”). At the divorce hearing she argued that her chances of ever becoming self-supporting were slim given her age, health, outdated qualification, and limited exposure in the open labour market.

- Her husband on the other hand argued that she had “numerous skills and talents and has the potential to secure employment and earn a salary to support herself which when coupled with what she will receive from the accrued estate constitutes ample income to enable her to become self-sufficient.” Moreover he would retire in two years and his income would seriously decline as he would be dependent on his pension for his own support.

- Before we consider the legal aspects, an important factual finding by the Court was that the wife did indeed have at her disposal “numerous administrative skills and talents which will enable her to secure future employment”, and that there was no medical evidence to suggest that she could not find employment.

The law and the maintenance order

- As the Court put it: “The clean break principle after divorce has found resonance with our courts for many years.The aim of this principle is to ensure that the parties become financially independent of each other as soon as possible after divorce. This principle however has to be applied with due consideration of the particular circumstances of each case and if such circumstances permit.”

- The parties, said the Court, clearly wanted to “cut all ties and put an end to the marriage. In these circumstances, achieving a clean break finds resonance with this court.”

- Its conclusion: “Consistent with [the] principle of a clean break that resonates through our judgments, it is incumbent upon this court to equip the plaintiff to live independently of the defendant and to focus on developing and empowering herself to secure and sustain her future. In the circumstances, I am of the view that the required result which is the ultimate self-sufficiency of the plaintiff will be achieved by rehabilitative maintenance. I am further of the view that a proper analysis of the rationale behind the awarding of rehabilitative maintenance will conclude that an arbitrary period of the payment of rehabilitative maintenance will not address the ultimate achievement of self-sufficiency. A two year period of rehabilitative maintenance is justified in the circumstances.” (Emphasis supplied).

- For a period of 24 months after the divorce therefore, the husband must pay rehabilitative maintenance of R8,000 p.m. in addition to keeping his ex-wife on his medical aid and paying all her medical expenses.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“The stance adopted by the Municipality at the trial demonstrated a disturbing lack of appreciation of its legal obligation to have provided E[….] with a safe working environment.” (Extract from judgment below)

Our courts do not tolerate any form of sexual assault or harassment in the workplace and a recent High Court decision confirms the danger to both employees of engaging in this form of misconduct, and to employers of failing to address it.

The sexual assault and the damages claim

- In 2009 a “vibrant 23 year old woman” employed by a municipality as a clerk was sexually assaulted by her immediate superior, a Corporate Services Manager.

- The assault was described as follows: “As she looked up he bent down with his head over hers and, putting his mouth over hers, attempted to force his tongue into her mouth.She clenched her teeth and tried unsuccessfully to push him away.After a minute or so he desisted, leaving her with a mouthful of his saliva.She immediately wiped the saliva off her mouth. He then also tried to wipe her mouth with his hand but she knocked it away.” Importantly, the Court noted that that this was in no way just an attempt to “kiss” the victim; it was very far removed from a “kiss” and was instead a sexual assault.

- The victim subsequently resigned from her job “after her employer had made her employment intolerable compelling her to resign” and then for a variety of reasons decided to sue for damages for unlawful dismissal in the High Court rather than claim for unfair constructive dismissal via the CCMA (Commission for Conciliation, Mediation and Arbitration). Both avenues are available to any victim of such misconduct, and many factors will determine the best choice in any particular case.

- Thus began what proved to be the start of a long and gruelling saga, leading firstly to a 2016 High Court finding in the victim’s favour that her employer and the manager were both liable to her for “such damages as she may be able to prove she has suffered in consequence of the sexual assault upon her”.

- Back to the High Court went the victim to prove her damages. She had, held the Court after hearing all the evidence, been “deeply traumatized, she suffered from post traumatic stress disorder requiring extensive psychotherapy and “the course of the life of the deeply traumatised 34 year old woman who testified at the trial on quantum in late July 2020 had been much changed as a result of the assault.”

The employer’s “supine approach of bovine resignation”

- The Court hauled the employer over the coals as it “took no responsibility for its conduct and denied liability at the trial. At no stage did it apologize for the tremendous suffering it had caused E[…]. … It exhausted every avenue open to it to avoid having to compensate E[…] for the wrong which she had suffered at its hands.”

- Although the manager was found guilty of gross misconduct at a disciplinary enquiry, his sanction was a two-week suspension without pay rather than dismissal, an outcome described by the Court as “mindboggling given the character of the offence, the circumstance that [the manager] had abused his position of authority by assaulting a female subordinate who was in a particularly vulnerable position in that she was a temporary employee at the time that the assault occurred. Furthermore [the manager] did not demonstrate any remorse, remaining defiant to the end. Where an employee has been found guilty of gross misconduct and fails to take the first step towards rehabilitation by acknowledging his wrongdoing, there can be little scope for corrective or progressive discipline.” (Also relevant – the manager had received a suspended sentence of imprisonment after the victim laid charges against him, and he was already on a final written warning for theft from his employer.)

- The employer’s “approach of washing its hands of the matter, á la Pontius Pilate, fell woefully short of what was required of an employer in the circumstances. The Municipality abdicated its responsibilities to protect E[…] and adopted a supine approach of bovine resignation” (emphasis supplied).

- There was much more from the Court in the same vein – the employer had, “through protracted litigation, made her wait so long for justice, thereby adding to her suffering …On a human level, the defence which was put up by the Municipality was devoid of introspection, humility or compassion … it had lengthened and intensified the trauma suffered by E[…] … there was no, as it were, corporate repentance … The Municipality was quick to defend the litigation and slow to listen to E[…]”.

The end result – the employer and the manager must “jointly and severally” pay to the victim a total of R3,998,955.02 in damages for loss of earnings, psychological/medical expenses, and general damages. They are also in for (doubtless substantial) legal costs, including the costs of four expert witnesses.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Bankruptcy – a fate worse than debt” (Anon)

One of a Body Corporate’s fundamental duties is to collect monthly levies from the scheme’s members, and to take robust action to recover any arrears. As with any other creditor/debtor relationship however, trying to recover debt can be an exercise in frustration and delay, and the more recalcitrant the debtor, the greater the temptation to “go straight for the jugular” by applying to sequestrate the debtor’s estate.

You will have to show that the sequestration is to the advantage of creditors as a whole – not just to you – but that isn’t the only consideration. You will be throwing good money after bad if you end up having to pay a “contribution to the costs of sequestration”.

The recent case of a sectional title Body Corporate, which perhaps thought that it was protected from this particular danger because of its statutory preferences for recovery of arrear levies prior to transfer, illustrates the danger.

But before we get to the facts and the outcome of that case let’s have a quick look at the general principles involved.

What is a “contribution to costs” and who has to pay it?

If you want to share in the net proceeds of an insolvent estate, you must formally prove your claim at a meeting of creditors convened by the trustee of the insolvent estate. If you don’t do that, you wave goodbye to any possible dividend and will be writing off the debt.

On the other hand, if you decide to prove your claim you may be at risk of having to pay into the estate as well as writing off the debt – talk about adding insult to injury! That danger arises if the costs of sequestrating the estate exceed the funds in the estate available to pay them. In that event the trustee of the insolvent estate will recover a “contribution to costs” from proved creditors – including you if your claim was proved as above.

The special danger of being the “petitioning creditor”

The creditor who applies for the debtor’s sequestration is – as “the petitioning creditor” – liable to contribute to the shortfall even without proving a claim. In other words, unlike other creditors, you cannot protect yourself from contributing to costs by holding back the claim – you are “deemed” to have proved it. That’s why, although applying for sequestration can be an excellent way of recovering debt from a recalcitrant debtor, it is essential to first consider the danger of contribution.

How “secured creditors” can protect themselves

Also relevant to our story is that a creditor holding security (such as a bond over the insolvent’s property) must prove its secured claim in order to be paid out the net proceeds of its security. A secured creditor can, if it suffers a shortfall after being paid out those net proceeds of its security, also share in the “free residue” of the estate. The “free residue” is the net proceeds of all unencumbered assets available for distribution to creditors. The secured creditor’s share in this event will be based on the “concurrent” portion of its claim, in other words it is now a concurrent creditor.

This is where the danger comes in because any contribution payable is payable in the free residue by concurrent creditors. A secured creditor can largely protect itself from this danger by “relying on the proceeds of its security” to satisfy its claim. By doing so it waives its concurrent claim for the shortfall, but equally it no longer has to contribute along with the other proved (or petitioning) concurrent creditors. It will now only have to contribute when there are no other such creditors, or when other contributors are unable to pay their share.

The case of the Body Corporate that sequestrated to recover arrears – and paid the price

Let’s see how those principles were applied in a recent Supreme Court of Appeal (SCA) case –

- The owner of two sectional title units, bonded to separate banks, was unable to pay his levies. The Body Corporate sequestrated his estate, and his two units were sold. Only the two banks proved claims.

- This was where the Body Corporate’s statutory protection for arrear levies came in. No transfer can be registered in the Deeds Office until all rates and taxes (and levies in the case of Bodies Corporate and Homeowners Associations) have been paid in full. Thus the arrear levies were paid in full to the Body Corporate by the transferring attorneys. “Done and dusted” thought the Body Corporate, but it was not to be.

- There was a shortfall in the insolvent estate, and the trustee tried to recover the resultant contribution from the two banks (the bondholders) who had proved their claims in the estate.

- The banks objected, arguing that because they had relied on their security in proving their claims, they were not liable to contribute (as above). The Body Corporate, they argued, was as the petitioning creditor liable for the contribution despite not having proved its claim.

- The Body Corporate on the other hand argued that it could never be liable for a contribution. Although it was indeed the petitioning creditor, it had never proved a claim against the estate and the arrear levies had been paid to it in full, as required by law, before transfer of the properties.

- To cut a long story short, the dispute wound its way through our courts and ended up in the SCA, which, after a detailed examination of the relevant law, held the Body Corporate as petitioning creditor to be solely liable for the full amount of the contribution to costs (R46 663.16).

Bodies Corporate beware!

The Court’s reasoning in reaching this conclusion will be of great interest to the lawyers amongst us, but the bottom line for Bodies Corporate is this – if you sequestrate to recover arrears, you could well end up carrying the full brunt of any contribution to costs.

So perhaps take advice on whether you can/should rather use other debt collection processes, including perhaps applying to the CSOS (Community Schemes Ombud Service) to order and enforce payment of the arrears.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Virtual meetings are here to stay. Make the most of them with “Optimising the virtual boardroom: A guide to planning and executing virtual board meetings” from Nasdaq Governance Solutions on Moneyweb.

Learn how to –

- “Build a virtual board table” (“creating a virtual seating arrangement” and so on),

- “Mitigate meeting day glitches” (we’ve all wasted time on fiascos!), and

- “Keep it confidential” (paramount).

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

Note: This is a complex topic and there is no substitute for tailored professional advice. What is set out below is of necessity no more than a simplified summary of some practical highlights.

You and your business are at substantial risk if you aren’t fully compliant with POPIA (the Protection of Personal Information Act) on 1 July 2021.

The clock is ticking! Have a look at the Information Regulator’s Countdown Clock here to see exactly how many days (and hours, minutes, and seconds!) you have left.

Be ready! Be compliant! Ask yourself these eleven questions –

- Does POPIA really apply to us?

As soon as you in any way “process” (collect, use, manage, store, share, destroy and the like) any personal information relating to a “data subject” (suppliers, customers, members, employees and so on – whether individuals or “juristic persons” such as corporates and the like), you are a “responsible party”.The formal definition of a responsible party is “a public or private body or any other person which, alone or in conjunction with others, determines the purpose of and means for processing personal information” – very few businesses and organisations will fall outside that net. Equally you are unlikely to fall under exemptions such as that applying to information processed “in the course of a purely personal or household activity”.But don’t panic –. compliance is easily attainable for most businesses, particularly if you are a smaller operation with little in the way of sensitive personal information. Answer the questions below to get a feel for areas you need to concentrate on now. - What risks do we run if we don’t comply with POPIA?

If a data subject suffers any loss as a result of your breach of POPIA, the subject (or the Regulator at the request of the subject) can sue you for damages and you will be liable even if your breach was unintentional and not negligent. You also face criminal prosecution, penalties and administrative fines for some breaches. - Have we registered our Information Officer/s?

You must register your Information Officer (“IO”) with the Information Regulator – go to the Regulator’s Online Portal for the online and PDF versions of the registration form, plus the email address for support enquiries and a link to the Search page. The IO is responsible (and liable) for all compliance duties, working with the Regulator, establishing procedures, and the like. You are automatically your business’ IO if you are its “Head” i.e., a sole trader, any partner in a partnership, or (in respect of a “juristic person” such as a company) the CEO, MD or “equivalent officer”. You can “duly authorise” another person in the business (management level or above) to act as IO and you can designate one or more employees (again management level or above) as “Deputy Information Officers”. - Do we have a list of all personal information we hold, and how and why we hold it?

Make a full list of all the personal information you hold/process, whether physically or in electronic form. Then evaluate it against the test that, to collect and “process” personal information lawfully, you need to be able to show that you are acting safely, lawfully, and reasonably in a manner that doesn’t infringe the data subject’s privacy.You must show that “given the purpose for which it is processed, it is adequate, relevant and not excessive”. Data can only be collected for a specific purpose related to your business activities and can only be retained so long as you legitimately need to (or are allowed to) keep it for that purpose. - What security measures do we have in place?

You must “secure the integrity and confidentiality of personal information in [your] possession or under [your] control by taking appropriate, reasonable technical and organisational measures to prevent … loss of, damage to or unauthorised destruction of personal information … and unlawful access to or processing of personal information.”You are at great risk of liability and penalties if you suffer any form of data breach from a risk that is “reasonably foreseeable” unless you can prove that you took steps to “establish and maintain appropriate safeguards” against those risks. If you haven’t already done so, brainstorm with your team all possible internal and external vulnerabilities (physical as well as electronic) and address them. - Do third parties hold/process personal information for us?

If third parties (“operators”), hold or process any personal information for you, they must act with your authority, treat the information as confidential, and have in place all the above security measures. Further restrictions apply if the third party is outside South Africa. - Do we know what to do if we suffer a breach?

Any actual or suspected breaches (called “security compromises” in POPIA) must be reported “as soon as reasonably possible” to both the Information Regulator and the data subject/s involved. - Do we do any “direct marketing” and if so do we comply with all requirements?

Most businesses don’t think of themselves as doing any “direct marketing”, but the definition is wide and includes “any approach” to a data subject “for the direct or indirect purpose of … promoting or offering to supply, in the ordinary course of business, any goods or services to the data subject…”. So for example, emailing or WhatsApping your customers about a new product or a special offer will put you into that net.If your approach is by means of “any form of electronic communication, including automatic calling machines, facsimile machines, SMSs or e-mail”, you must observe strict limits. Whilst you can as a general proposition market existing customers/clients in respect of “similar products or services” (there are limits and recipients must be able to “opt-out” at any stage), potential new customers can only be marketed with their consent, i.e., on an “opt-in” basis. They can be approached only once for that consent so keep a record of everyone you have asked. - Does our website use cookies and if so do we have a cookie notice and policy in place?

As countries around the world ramp up their privacy laws, we will all see many more examples of “cookie notices” on websites we visit. You may wonder how your own website should be configured, and the short answer is that if it uses cookies (almost all do), POPIA very likely applies despite the fact that there is no specific mention of cookies in the current legislation. Bottom line – to be on the safe side, have a cookie notice and policy in place. Keep yours simple and user-friendly. - Do we have a privacy policy and a POPIA manual in place?

POPIA – unlike PAIA (the Promotion of Access to Information Act) – doesn’t require you to have a POPIA manual in place but in larger businesses it is certainly a good idea to prepare one.However you should certainly have a privacy policy in place. Make sure that everyone in your organisation is aware of it and of how critical it is to comply with it at all times. - Is our staff team ready?

Check that everyone in your business understands your compliance plan and their own individual roles and responsibilities in it. Make sure that nothing falls through the cracks – assign specific tasks to specific staff members.

Bodies Corporate and Homeowners Associations – how POPIA affects you

Bodies Corporate and Homeowners Associations (HOAs) fall into the POPIA compliance net and should be asking themselves the questions above.

In assessing what personal information you hold, how and why you hold it, and who you are sharing it with, remember to include not only scheme owners and HOA members but also your auditors, attorneys, managing agents, the CSOS (Community Schemes Ombud Service), security service providers and the like.

If you have gate security in the form of visitor registers, scanning of licence plates and driver’s licences and so on, be ready to address questions around having lawful reason for collection and retention of all the personal information you are gathering in this manner.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

“Before anything else, preparation is the key to success” (Alexander Graham Bell)

You sell your house, give the signed sale agreement to your attorney, and wait to get paid out as soon as the property is transferred in the Deeds Office. What could possibly go wrong?

Quite a bit as it turns out, but perhaps the most frequent “sinker of sales” is a failure by one party or the other to meet a “suspensive condition” (often also referred to as a “condition precedent”).

As our courts have put it “a suspensive condition suspends the operation of all obligations flowing from a contract until occurrence of a future uncertain event. If the uncertain future event does not occur, the obligations never come into operation.” In other words, there is no binding sale at all until all suspensive conditions have been met.

The bond clause

A very common suspensive clause in property sale agreements, where the buyer cannot pay the purchase price in cash, is the “bond clause” making the sale subject to the buyer obtaining a “bond approval” from a financial institution (usually a bank). The bank loans the money to the buyer against the security of a mortgage bond over the property.

The bond clause is of course an essential escape route for you if you are a buyer needing to raise a loan. As a seller on the other hand you want the clause tightly drawn to stop the buyer using it as an excuse to pull out of the deal if the dreaded “buyer’s remorse” should set in after the sale.

For both parties it is essential to ensure that the clause is properly drawn to reflect clearly and correctly what you are both agreeing to. Preparation is key here! Our law reports are replete with bitter and expensive disputes over bond clauses, many of them avoidable had the parties proactively sought legal assistance before signing the sale agreement.

What should be in the bond clause?

In broad terms a bond clause will provide that the sale agreement is suspended until the bank approves the bond, and that the agreement will lapse if approval is not given by the date and in the amount specified in the clause.

Beyond that, make sure that there are no grey areas around what the deadline is or around what exactly will constitute “bond approval”. What format must it be in? Is it enough that an approval is granted, or must it be communicated to the seller before deadline? Is the bank’s offer to the buyer subject to the National Credit Act and if so on what basis can the buyer reject the offer? Is it enough to specify that the bond approval should be on the bank’s “usual terms and conditions”? What if the buyer rejects a reasonable offer from the bank in order to get out of the sale? And so on…

As a seller, if you are concerned about your buyer not being able to raise the required finance, consider adding a “72-hour clause” to the sale (ask your attorney for advice on this).

As a buyer, consider specifying the maximum interest rate at which you will accept the bank’s offer of a loan, or you could find yourself tied to unaffordable bond repayments.

Each case will be different, and our courts will always look at the specific wording of each particular case. So make sure the clause is specifically tailored to protect both parties in your respective circumstances.

Amending or waiving the bond clause

What if the buyer can’t get an offer from a bank by due date or in the required amount or (if the buyer specified a maximum interest rate as suggested above) at the required interest rate?

If that happens, the parties can agree to vary the agreement – perhaps to give the buyer more time to raise the bond, or to change the amount of the bond. Just remember that that must be done in a written, signed agreement before the due date. After the due date the whole agreement will have lapsed and there will be no contract left to amend.

Alternatively as a buyer, you have the option to “waive” the bond condition. You can do so unilaterally (i.e., without the seller’s agreement), provided again that the agreement hasn’t already lapsed, and provided that nothing in the agreement prevents such a waiver.

Importantly, you can only waive a suspensive condition where it is for your “exclusive benefit”. A bond clause will usually qualify in that it is normally there purely to protect you from being tied to an agreement you cannot afford – but perhaps avoid any possible doubt by specifying that in the clause.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews