“Dance like no one is watching, but text, post, and email like it will be read in court one day.” (Anon)

When can the target of rude comments and insults on a community Facebook group sue?

The High Court recently grappled with a community debate over free-roaming jackals that turned sour.

The golf estate and the Facebook group

The scene here is one of Sandton’s large and secure golf estates, whose closed Facebook group, aimed at fostering community spirit, reaches some 1,800 residents.

Jackals roaming freely on the estate were at the heart of this dispute, with residents split into two opposing camps.

- In one camp, those believing that all wildlife in the estate should be left alone – including the jackals.

- In the other camp, those arguing that, as well as being predators dangerous to other animals (including domestic pets), jackals are carriers of rabies. Presumably this group advocates some form of control measure, no doubt an emotive topic.

Cat pics and Karen insults

The online debate between the two sides began civilly enough, but that changed with a series of posts by a prominent supporter of the “hands-off-the-jackals” lobby. In criticising the other camp, she targeted one of them by name. Stung, the recipient of what she perceived as insulting and defamatory attacks, demanded that her opponent remove the posts and apologise to her.

Central to the outcome of this case are the posts themselves. They included an image of a cat in a spiked vest (with the comment “maybe this will help the cats”), suggestions that the target of the posts shouldn’t be living in Africa, that she had published false information on the group, and that she was “stupid” and a “stupid keyboard muppet”. She read further posts as referring to her as a “B” (she took this to mean “bitch”) and as caricaturing her as a dog (with a bob haircut like hers) and as a “Karen”.

Off to court with a two-pronged attack

As a professional (actually a business rescue practitioner), the complainant wasn’t prepared to take any of that lying down. Offended by the poster’s refusal to retract, she sued her in the Magistrate’s Court for damages of R250,000, asking also for orders to remove the posts and apologise publicly for them.

She lost, appealed to the High Court and lost again. Why?

It’s important to note firstly that she had launched a two-pronged legal attack, enabling her to prove a valid claim for either or both of actionable insult (where offending statements injure your dignity or self-worth) and defamation (where they damage your reputation). To win, she needed to show either that the statements referred to her and were defamatory of her, or that they were wrongful and hurt her dignity.

Her failure to convince the Court that she had a case was partly because she hadn’t been able to prove all the facts needed to establish a case. But it was also rooted in two principles which anyone engaging in public debate (online or otherwise), and anyone thinking that an insult is perfectly fine if it’s structured as a “joke” or “jest”, needs to take note of.

Let’s have a look at each principle.

Public debate is not for sissies

The Court: “The law expects those who take part in public discourse to do so with a degree of pliancy and robustness. A subjectively hurtful remark is not wrongful unless a reasonable person in the plaintiff’s position would take exception to it.”

More particularly, this being a closed group of neighbours in a security complex: “Those who engage in online debate about matters of mutual interest between neighbours ought reasonably to foresee that the criticism they sustain may be tart and, at times, discourteous.”

In this case, while some of the posts were definitely rude and hurtful, no reasonable person would have thought that they had tarnished their target’s reputation. Rather, readers would have thought less of the poster “because she was unable to keep to civil terms of debate.”

Everything said in jest?

Some, but certainly not all, “jokes” are safely posted. The poster of this “cat in spikes” picture said it was just a light-hearted joke, and the Court agreed. A joke can certainly be defamatory if it’s a deliberate attack on the target’s reputation – but in this context, it was just “a satire of the entire debate between the parties.” It wasn’t, said the Court, “of the defamatory kind”.

Turning to what appears to have been another attempt at a joke in the form of the dog caricature and “Karen” reference, what saved the poster here was the lack of proof that this was actually aimed at the claimant. Had it been, calling her a “Karen” (“a privileged, entitled woman with a thin skin and a quick temper”) would have opened her up to ridicule and “would probably have been defamatory”.

There’s a fine line or two there. Call us before posting if you aren’t sure that you’re on solid ground!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“There’s no trust, no faith, no honesty in men.” (William Shakespeare, in Romeo and Juliet)

A recent Labour Court decision is a stark reminder to employees that an employment relationship is founded on trust, and that any breach of that trust could justify dismissal.

Pocketing a 50c coin to balance her till

The responsibilities of a bank teller included “balancing cash daily, reporting differences, as well as maintaining effective security controls, including maintaining a high level of honesty, integrity and ethical standards.”

Her clean record over the four years of her employment ended abruptly when a monthly surprise check of the cash balance in her till revealed a discrepancy in the form of a bag of R1 coins totalling R20, unaccounted for and therefore in violation of banking rules and procedures.

The resulting investigation revealed, as recorded on CCTV, the teller’s various failed attempts at balancing her till, which she had ultimately succeeded in doing only by pocketing a 50c coin from the till.

A subsequent disciplinary enquiry found her guilty on charges of misconduct in the form of dishonesty, falsification of balancing records and misappropriation of funds from her till. She referred her dismissal case to the CCMA (Commission for Conciliation, Mediation and Arbitration), which refused her application.

In finding her dismissal to have been fair, the arbitrator rejected both the teller’s claims that her till discrepancies resulted from her ill health, and her denial of taking the 50c to manipulate the system (the CCTV record was, it seems, crystal clear on that point). The court also remarked on her contradictory statements as to the “miraculous” bag of R1 coins.

Critically, the teller had been trained in her duties and was well aware of what was expected of her in line with the bank’s Code of Ethics. Moreover, the bank’s Disciplinary Code provides that falsification of bank records is a dismissible offence as a destroyer of the employer-employee trust relationship.

Undaunted, the teller took the CCMA’s award on review to the Labour Court, which made short work of confirming her dismissal.

It’s the breach of trust that counts, not the amount involved

As our courts have confirmed many times, the employer-employee relationship requires an employee to act honestly and in good faith. The trust which the employer places in the employee underlies their whole relationship, and any breach of that trust risks dismissal.

Even an apparently minor act of dishonesty can justify dismissal if it has resulted in a breakdown of trust that makes continued employment intolerable. The final decision of whether or not dismissal will be appropriate for a particular act of misconduct will depend on all the circumstances.

4 practical tips for employers

For employers, preparation is key in ensuring that you are able to dismiss a dishonest employee without falling foul of our employment laws. Start with the basics:

- Your employment contracts and codes are critical: As we saw in this case, the bank’s strictly worded Code of Ethics and Disciplinary Code were central to proving the fairness of the dismissal. Your employment contracts should incorporate reference to zero-tolerance policies that leave employees no wiggle room when it comes to understanding that any act of theft or dishonesty, no matter how minor, will justify dismissal. Incorporate reference also to the monitoring and checking processes you will apply – it was the “surprise monthly till check” that cooked this teller’s goose.

Every workplace will have its own unique requirements in this regard, so contracts and codes tailored to your circumstances are vital.

- Training is essential: As we again saw in this case, a deciding factor in the Court’s decision was the fact that the teller had received adequate training in her duties and so couldn’t claim ignorance of the requirements that she balance her till, report discrepancies, act honestly, etc.

- Proof is key: The CCTV footage of the teller pocking money from her till was critical in proving that she deliberately flouted the rules and stole from her till. Whatever monitoring devices and processes you may have in place (and do remember to ask us how you can use things like CCTV monitoring without being accused of an unfair labour practice!), make sure to collate and preserve it as soon as any incident of misconduct comes to light. You might have to retain it for a long time (nearly four years so far in this case).

- Your disciplinary process must also be fair: Remember that proving “substantive fairness” (a fair and lawful reason for dismissal) is only one part of the equation. You must also be able to show that all your disciplinary processes are “procedurally fair” (i.e. that a fair process was followed).

As always with our employment laws, the requirements are complex and the costs of getting them wrong are high, so don’t hesitate to ask us for advice and help every step of the way.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“Time shall unfold what plighted cunning hides.” (William Shakespeare, in King Lear)

A recent High Court judgment confirms, yet again, that if a property seller knows about a hidden defect and keeps it quiet, no exemption clause will save them.

A loud roar, rolling flames, and a dream home turns to ashes

A family thought they were moving into a solid, well-built family home (a dual-level freestanding residential townhouse). They had no idea a hidden hazard was buried in the walls above their fireplace.

They found out on a cold and rainy Free State night when they lit a winter fire, as they had done many times before. This time they were in for a shock. All went well until, watching television some hours later, they heard a loud crack like a gunshot…

When the man of the house looked up the staircase, he noticed a glow. He found that the top floor spare room was on fire, with the curtains and bed already alight. A loud roar and flames rolling under the cornice caused him to retreat. He shouted to his wife to gather their pets and call for help, and they escaped outside to await the arrival of the fire department.

The family got out unscathed. But the extensive damage caused by the fire and the collapse of the roof rendered the unit uninhabitable.

The hidden fire hazard

Unbeknownst to the buyers, during construction, a roof truss beam had been built through the chimney brickwork. Building regulations read with the applicable code of practice forbid this, because any timber near a flue is a fire waiting to happen: “Combustible material such as a timber floor joist, trimmer or roof truss shall not be built within 200mm of the inside of a chimney; and … No flue pipe shall be designed and installed in such a manner that it will cause a fire hazard to any adjacent material.”

Faced with a devastated home and huge repair costs, the buyers took the developers, who had both built and sold the house, to the High Court, where a forensic fire expert explained that the origin of the fire could be traced to the beam in question. Over time, repeated heat exposure had dried out and charred the timber. On the fateful evening, it finally caught alight, and the fire spread to the polystyrene ceiling cornices, which melted and dropped flaming debris onto bedding in the upstairs room directly above the fireplace.

Voetstoots? Forget it!

The developers argued they weren’t liable because the sale agreement contained a standard exemption (“voetstoots”) clause and could not therefore be held to account for a hidden defect such as this one.

In short, the developer’s position was: “You bought the house as it stood, defects and all, whether you could see them or not.” They also pointed out that the buyers had signed an acknowledgement that they’d inspected the house.

But the Court was clear: “It is the duty of the seller to deliver the thing sold to the buyer without any defects.” Voetstoots clauses don’t give a seller free rein to hide behind the contract if there’s fraud or dishonesty:

- The defect was “latent”, in that it was hidden inside the chimney and could not have been discovered by a normal inspection.

- The developer, as the builder, must have known of the latent defect, and whilst “fraud will not lightly be inferred, the fact that the chimney was not represented on the approved building plans occasions the reasonable inference that it fraudulently concealed the defect.”

Bottom line? By failing to disclose a defect that was dangerous and unlawful, the developer crossed the line from simple non-disclosure to fraudulent concealment.

Here’s how to avoid disaster and dispute

- Sellers: Check carefully for any possible defects and make honest disclosure part of your sale process, particularly when completing the “mandatory disclosure form” that must be attached to the sale agreement. And don’t rely blindly on a standard exemption clause – it’s no guarantee of protection if a hidden defect comes back to haunt you.

- Buyers: Always ask questions. Look at approved building plans, think of commissioning an independent home inspection, and don’t be shy to raise any concerns. If you suspect fraud after buying, don’t wait – get legal advice fast.

The bottom line

Hidden defects don’t stay hidden forever, no matter how cleverly concealed. Sooner or later, as Shakespeare put it, “time shall unfold what plighted cunning hides.”

If you find yourself facing the fallout of a seller’s dishonesty, we’ll help you protect your rights and recover what you’ve lost.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“You can’t go back and change the beginning, but you can start where you are and change the ending.” (C.S. Lewis)

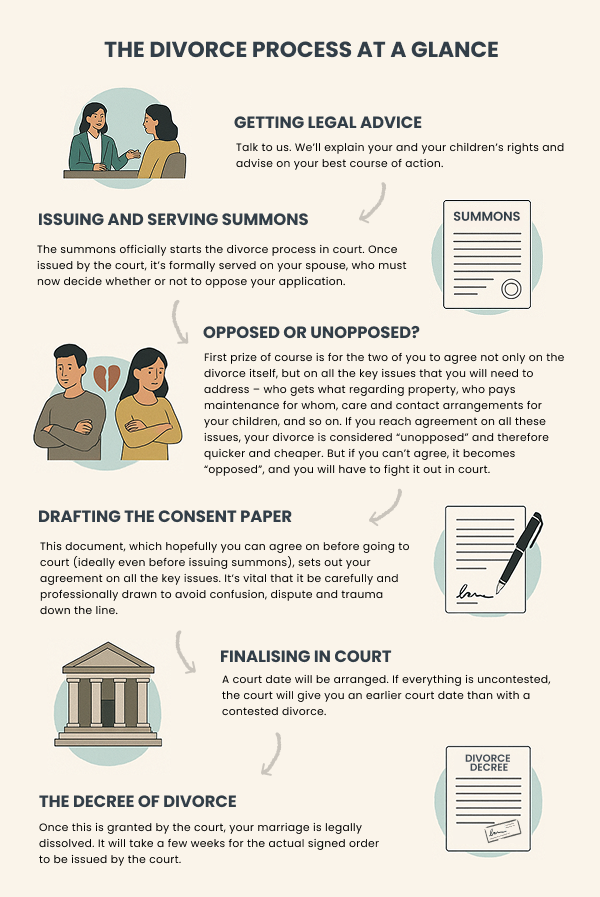

Divorce is traumatic, to the extent that it’s widely considered to be the second most stressful life event (behind only the death of a spouse, and ahead of marital separation and going to jail!).

But if you’ve come to the conclusion that your marriage is so unhappy or toxic that you have no alternative but to put an end to it, you’ll need to know how to go about obtaining a divorce, and what your legal rights are.

The whole process can feel overwhelming, but it needn’t be. Here’s a clear, simplified overview, followed by a Q & A section to address some of the concerns and queries you may be grappling with.

9 common questions answered

Here are some of the most commonly asked questions. Let us know if you have any others!

- Do I have grounds for divorce? Our law has since 1979 had a “no fault” concept, so all you must show is that your marriage has broken down irretrievably, with no reasonable possibility of reconciliation. Mental illness or coma are other grounds for divorce but fortunately they rarely apply.

- How long does it all take? In an uncontested divorce (depending on how quickly you reach agreement, how busy the courts are, and a myriad of other factors) you should work on between two and three months. A complex contested divorce on the other hand could take years, particularly when fought bitterly through all the appeal courts.

- How are our children protected? Parenting plans, care and contact, maintenance and schooling arrangements can and should be settled by agreement if possible. Otherwise, the Family Advocate’s office can help – it’s a free and impartial service, tasked with protecting the welfare of children through investigation, mediation, reporting and making recommendations to the court. If you are still deadlocked and leave it to the court to decide one way or the other, bear in mind that our courts always put your children’s best interests first – no exceptions.

- What about maintenance for me and our children? Both of you must contribute to the reasonable financial needs of your children based on your respective financial positions, and child maintenance orders in favour of the parent with primary care (“custody” in the old terminology) are commonly granted. Orders for spousal maintenance (“alimony” in American legalese) are less common and depend on a host of factors. You may also be able to claim interim maintenance pending the divorce.

- How much will this cost me? We can give you an idea of the likely cost based on whether or not the divorce is contested and the complexity of the issues involved. A simple, uncontested divorce will always be the least costly option. If the divorce is contested and you can’t afford to pay legal fees, you may be entitled to a contribution to your legal costs from your spouse. Sometimes, when granting a disputed divorce, a court will order one of you to pay the other’s costs, but the general rule is that each of you will pay your own costs. And of course you can always agree between yourselves who pays what costs.

- What assets will I get? What you are legally entitled to depends largely on whether you are married in community of property or out of community of property (with or without accrual), and on what your ante-nuptial contract (if you made one) says. The court also has wide discretion to order a redistribution of assets in your favour in appropriate cases – and of course you can agree between the two of you to divide assets any way you want.

- What if there’s domestic abuse? We’ll help you get an urgent protection order to keep you and your children safe.

- I really don’t want this to go to trial, how can I avoid that? Mediation is often an effective way to help parties reach an agreement on contentious issues. The reality is that most divorce disputes are eventually settled by agreement – if not upfront, then “on the steps of the court”, or perhaps only after battle has begun and everyone can see which way the wind’s blowing.

- How does Home Affairs know I’m divorced? We’ll help you send a certified copy of the divorce decree to Home Affairs to update your marital status on the National Population Register.

Talk to us if you’re considering divorce – or even if you just want to understand your options.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“Diplomats operate through deadlock, which is the way by which two sides can test each other’s determination.” (Henry Kissinger)

Running a business with a partner can work brilliantly – until it doesn’t. When co-directors or shareholders fall out and can no longer see eye to eye, the company can grind to a halt, meaning everyone loses.

If the “deadlock” is just the two sides playing diplomat by testing each other’s determination to fight to the finish, there’s a chance they’ll negotiate a settlement before the company actually fails.

But if you find yourself in a fatal stalemate, you should think of cutting your losses and putting your company out of its misery altogether. A recent High Court decision provides an excellent example of how you can do just that.

The director disputes that destroyed a profitable business

The players in this unhappy saga were the 50/50 shareholders, and co-directors, of a small business importing tents from China.

At first, their arrangement clearly worked well. But as time passed, they fell out badly over disputes relating to the terms on which their own businesses (one in Kenya, the other in South Africa) could buy tents from the importer.

Their own attempts to resolve things failed, and the seriousness of their quarrelling led to allegations of fraud and of unpaid debts, together with threats to have one director declared a delinquent director and attempts to bring a third director into play.

A buyout attempt having failed, one of the directors applied for liquidation of the company. The other director’s fierce opposition rested on him asking for everything to be put on hold while he launched alternative litigation against his opponent.

But can you liquidate a solvent company?

Normally, only insolvent companies face liquidation, but the Companies Act allows courts discretion to order the winding up of a solvent company (a company able to pay its debts) in a range of circumstances. Three of those grounds for liquidation are relevant here:

- There is deadlock between the directors in the management of the company and the shareholders are unable to break the deadlock, resulting in or threatening irreparable injury to the company, or

- The result of the deadlock is that the business of the company cannot be carried on to the advantage of the shareholders generally, or

- It is otherwise “just and equitable” for the company to be wound up.

Past the point of no return

In granting the liquidation order, the Court found that the relationship between the directors had broken down irretrievably, and the resulting deadlock had reached the point of no return. The shareholders would be unable to break the deadlock and that had resulted in irreparable injury to the company. Its business could not be conducted for the advantage of shareholders.

The Court went further, holding that in any event it was just and equitable to order winding up. The mutual trust and confidence between the shareholders had been destroyed, there had been a complete breakdown of relationship between the directors and shareholders, and the company’s “substratum” (fundamental reason for existence) had disappeared.

Prevention is better than cure

When you co-own a company, especially if it’s split 50/50, stalemate is an ever-present risk. If this happens and you can’t agree on how to buy each other out or on how to break the deadlock, you could lose the entire business.

Prevention being better than cure, good planning upfront is essential. So, if you run or plan to start a business with partners, make sure that your shareholders’ agreement and other documentation includes clear and workable mechanisms for avoiding dispute, and for breaking deadlock if it occurs.

Common solutions are:

- As a way of hopefully preventing disagreements from arising, set out in writing clear boundaries as to each party’s contributions to the business, their roles in management and funding, profit sharing, obligations of good faith towards each other and to the company, and so on – every situation will call for different wording.

- Clauses to allow one owner to buy the other’s shares are essential, with a clear process for determining value and resolving any disagreement over price or terms.

- Provide for independent arbitration or mediation to resolve any disputes that may arise generally.

These safeguards are unfortunately no magic bullet, as witnessed by the inability of the directors/shareholders in this case to reach any form of agreement. This despite having deadlock-breaking mechanisms in their shareholders agreement, and despite their attempts at negotiation and mediation.

But safeguards are a lot better than nothing, and they will most definitely reduce the risk of you both ending up in court, paying legal fees and being grilled in witness boxes while your business dies. If that happens, everyone loses.

Bottom line? Disputes happen, but they don’t have to kill your business. Speak to us if you’d like advice on your company’s structure, and for help in drafting a shareholders’ agreement that protects you both if things turn sour.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“You must take reasonable care to avoid acts or omissions which you can reasonably foresee would be likely to injure your neighbour.” (Lord Atkin in the groundbreaking 1932 House of Lords decision that found a soft drink manufacturer liable for a consumer’s shock and illness after she discovered a decomposed snail in the remains of her ginger beer.)

A simple burger night turned into an ordeal for a diner who swallowed a “needle-like object” hidden in her meal. The High Court’s confirmation that she can claim damages from the restaurant is a reminder of how strictly our courts hold businesses to their duty of care towards customers.

What happened?

The diner and her husband visited their favourite restaurant in Stellenbosch for burgers and a bottle of wine. Her relaxed night out turned into a nightmare when, halfway through her burger, she felt sudden pain and realised something was stuck in her throat. Panicking after she couldn’t get it down, she rushed to the bathroom, coughing and noticing blood in the basin. A trip to the emergency room confirmed her worst fears: X-rays revealed a “needle-like object” lodged in her oesophagus.

Despite emergency treatment and surgery attempts, she had to endure five days in hospital, repeated scans, and constant distress before the foreign object finally passed. She testified to the pain, humiliation and panic she experienced throughout the ordeal. We can imagine just how high her levels of anxiety must have been when she recalled the story of a family friend who died after swallowing a fish bone that punctured his intestines.

The law: Who’s responsible?

She sued the restaurant for damages, arguing that the business had a clear duty to serve safe food. The restaurant denied responsibility, saying it bought ingredients from trusted suppliers and followed standard food safety practices.

But the Court found that those defences didn’t hold up. The restaurant’s only witness wasn’t on duty on the night in question and could not say what safety checks were actually done. No staff testified about what happened in the kitchen or how such an object could have ended up in the meal.

Let the facts speak for themselves

In the end, the Court applied a well-known legal principle: If something happens that normally wouldn’t occur without negligence, like swallowing a sharp object hidden in food, the facts speak for themselves (“res ipsa loquitur” to lawyers). The business must then explain how it happened and show that it wasn’t at fault.

Here, there was no reasonable explanation. The restaurant controlled every step of the food preparation but failed to show how a foreign object could have slipped in without negligence. The business was found liable for all the harm suffered.

The key takeaways for businesses

This is a clear reminder that, in 1932 as today, if you serve the public, you have a duty to keep your premises and products safe. If something goes wrong, you must be able to prove that you took all reasonable steps to prevent harm. Fail to do this and you could be held liable for negligence.

We can help you check your supplier contracts, disclaimers and risk policies to make sure your business is protected.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“I love deadlines. I love the whooshing noise they make as they go by.” (Douglas Adams in The Salmon of Doubt)

Contracts often contain suspensive conditions, a common example being the bond clause in a property sale agreement. The standard bond clause provides that the buyer must obtain a bond by a set deadline, and everyone’s rights and obligations under the agreement are suspended until the bond is granted. If the bond isn’t granted by the deadline, there is no sale.

In practice, the buyer often struggles to meet the set deadline and asks for an extension. If that happens to you, be sure to structure the extension correctly and to get it done and dusted before the deadline expires.

Parties often think “oops, we both missed the deadline, but no worries, we want the sale to succeed so all we need do is agree to revive the agreement.” But that’s a fatal mistake, because if a suspensive condition fails, the contract dies and all your attempts to bring it back to life – usually by way of an addendum or an extension of the time limit – are doomed to fail. You will need a brand new contract if both of you still want to proceed.

Let’s illustrate this point with a Supreme Court of Appeal (SCA) decision in which the parties attempted to “revive” their agreement after the bond clause had already failed.

A deadline passes and a R5m house sale dies

In February 2020 (i.e. shortly before the economic shock of the pandemic), the buyers of a R5.15m house paid the agreed deposit on time but couldn’t raise the required bond of R4.95m before the deadline set out in the bond clause. A first addendum to the sale gave them another few days, and that addendum was valid because both parties signed it before the deadline expired.

But then the parties made a fatal mistake. Only after the extended deadline had whooshed merrily past did they sign a second addendum, agreeing to extend the date again and thus, they both believed, saving the sale.

The buyers now did more than just get a bond – they paid R1.95m in cash and provided bank guarantees for the rest. And they did all that before the second deadline expired, so all seemed well with the sale. Until Covid struck. That left the buyers with financial problems, so they tried to exit the sale and get their money back. “No deal,” said the seller, “the agreement is still valid and enforceable, you have to take transfer.”

Off to court went the buyers, eventually ending up in the SCA, which held the sale to be void and ordered the seller to refund them their R1.95m. The Court couldn’t have been clearer in ruling that when a suspensive condition (like a bond clause) isn’t fulfilled, the whole contract becomes unenforceable. This despite the fact that both buyer and seller clearly intended to proceed with the sale and thought they were validly reviving it with their second addendum.

Our law is clear – when a sale agreement has already lapsed, there is nothing you can do to revive it. Only a new agreement could have saved the sale, and the Court, on the facts, rejected the seller’s attempts to convince it that the second addendum was actually a new agreement. It was, said the Court, just an invalid attempt to revive a dead contract.

Here’s what to do to keep that sale alive and well

Every situation will be unique, but at the very least follow these three principles.

- Failed suspensive conditions (in particular bond clauses) are notorious sources of dispute when property sellers and buyers come to blows. Make sure yours is clearly worded and reflects exactly what you have agreed to. A professionally drawn sale agreement tailored to your needs really is a no-brainer here.

- Keep an eye on those deadlines! If you need to extend one, do so before it expires with a full, clear and signed addendum.

- If you happen to miss the boat there, a whole new agreement is essential. It may well incorporate the same terms and conditions as the original (updated where applicable of course) but nothing less than a brand new deed of sale will pass muster.

As always, sign nothing until we’ve checked it for you!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“In Africa there is a concept known as ‘ubuntu’ – the profound sense that we are human only through the humanity of others.” (Nelson Mandela)

International Nelson Mandela Day is celebrated worldwide on 18 July every year, but in South Africa the whole of July is Mandela Month.

What better time to talk about the concept of “ubuntu”, which emphasises our interconnectedness and interdependence, and embraces values like fairness, compassion, respect and dignity?

How does ubuntu influence your legal rights?

Our courts have often considered, and sometimes applied, the principles of ubuntu in a wide variety of legal contexts. The “it’s unfair and unjust!” defence pops up regularly (often when discussing whether something is “contrary to public policy”) in disputes of all kinds. Asset sales, property sales, leases, neighbours’ disputes, evictions, workplace litigation, franchise agreements, criminal sentencing cases, civil claims, defamation claims, trust disputes and so on – the list truly is endless.

For example, in 2023 the High Court refused to order the eviction of a group of tenants, despite the fact that they were in breach of their leases, on the basis that the eviction would render them homeless and thus the application for eviction was “completely devoid of any empathy for the [tenants’] living conditions. There is,” the court stressed, “in fact, no ubuntu at all.”

When is a contract unenforceable for being contrary to ubuntu?

When it comes to contracts, we have wide freedom to contract as we please, and people entering into agreements need to know with reasonable certainty that the law will help them enforce compliance with those agreements. Those principles have led our courts to confirm that the fundamental principle of “agreements must be honoured” or “you are bound by what you agree to” (“pacta sunt servanda” in lawyer speak) still underpins our law.

As the Constitutional Court has put it, “a court may not refuse to enforce contractual terms on the basis that the enforcement would, in its subjective view, be unfair, unreasonable or unduly harsh … It is only where a contractual term, or its enforcement, is so unfair, unreasonable or unjust that it is contrary to public policy that a court may refuse to enforce it. (Emphasis added.)

In practical terms, this means that as a general rule our courts will enforce agreements entered into freely and voluntarily. But they can still be persuaded to hold a contract void and unenforceable if satisfied that it is against public policy, a concept that is measured objectively and informed by constitutional values such as ubuntu. A good example is a 2013 High Court refusal to enforce an acceleration clause in a loan agreement because of its draconian implications – it would have allowed the lender to call up in full a debt of R7.6m after the borrower had failed, through a miscalculation, to pay just R86,57 in default interest.

Every case will be decided on its own facts and merits. That inevitably opens up grey areas, which in turn provide fertile ground for uncertainty, dispute, and litigation. So, although in practice our courts lean strongly in favour of enforcing agreements as they stand, rather be safe than sorry – the more closely your contracts of all types adhere to principles of fairness and justice, the less likely you are to see them challenged in court. (And the better you will sleep at night.)

Speak to us if you’re uncertain whether or not your contracts and other documentation will pass muster if measured against ubuntu.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“When cognitive capacities are the focus, the 70s are the new 50s.” (IMF)

Fake news articles suggesting that South Africa was implementing a new standard retirement age policy, supposedly from 30 May this year, recently went viral on social media. Convincingly structured to look realistic (AI’s dark hand there?), the articles suggested that 65 is the new universal standard retirement age for all employees across all sectors.

Complete hogwash.

What the law actually says

- Age discrimination is “automatically unfair”, and any employer found to be guilty of it by unlawfully forcing an employee to retire early faces a compensation order of up to 24 months’ remuneration (double the normal award for a run-of-the-mill unfair dismissal), re-instatement or re-employment.

- There is, however, an escape clause there for employers: “A dismissal based on age is fair if the employee has reached the normal or agreed retirement age for persons employed in that capacity.”

- Even where a dismissal itself is fair, you must still follow a fair process in implementing it – more on that below.

It’s an important topic, with increasing numbers of employees wanting to (or needing to) work into their 70s. A recent Labour Court ruling showing those principles in action is well worth taking note of.

The plumber forced to retire at 60

An artisan plumber with 12 years of service had his employment terminated when he turned 60.

He asked the Labour Court to declare his dismissal automatically unfair as other employees had been allowed to work until they were 65. What’s more, he denied ever agreeing to retire at 60.

The employer countered that it had a two-tier retirement policy which obliged employees with more physically demanding jobs (site workers such as artisan plumbers) to retire at 60 whilst supervisory and administrative personnel (such as foremen and office staff) only had to retire at 65.

On the facts, the Court declared the dismissal to have been fair, finding that the evidence pointed to the employee being subject to a retirement age of 60 because:

- The employer’s retirement policy was in line with the rules of the applicable Building Industry Pension Scheme.

- Although no signed copy of his full employment contract could be found, the employer did produce a standard annexure to such a contract, confirming retirement at 60 and “probably” signed by him (he denied signing it but agreed the signature looked like his).

- A number of his fellow plumbers had also been retired at 60 (he attended their retirement functions), and other cases of retirement at age 65 cited by him related to employees in the “65 tier” – that is in supervisory or administrative positions.

- Another plumber’s contract was produced, with the retirement provision in place.

Bottom line: the employee hadn’t proved that his retirement at the applicable retirement age of 60 was an automatically unfair dismissal, and the Court held his dismissal to be fair.

How to ensure that an age-related dismissal is fair

First prize is to specify an agreed retirement age in all your employment contracts, ideally from day one. If you want to add a retirement clause later, or to change anything about an existing clause, be sure to do so by negotiation and agreement, not unilaterally. And be sure to keep the original, fully-signed contract safe and accessible (unlike the employer in this case who had to rely on a scan of just the annexure to the contract).

Alternatively, be ready to prove that there is a “normal or agreed retirement age” for employees employed in the same capacity.

The dismissal must be genuinely based on the employee having reached retirement age and cannot, for example, be a disguised retrenchment or a dismissal for some other reason.

It’s crucial that you follow a fair process. Open communication, reasonable notice, and applying the rules consistently to all employees could be critical here.

Every case will be different, so ask us for advice specific to your situation.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews

“I charge you by the law.” (William Shakespeare in The Merchant of Venice)

Victims of crime are entitled to see the perpetrators brought to justice. Feeling that the justice system has failed you can cause significant psychological harm and feelings of victimisation.

So, what happens if you believe that you are the victim of a crime, which you duly report to the police – only to be told that the NPA (National Prosecuting Authority) has declined to prosecute?

You could of course console yourself with the thought that “well, at least I tried” and walk away unfazed. But if you feel strongly enough about it, you are not without legal remedy – in appropriate cases you could be advised to go the private prosecution route.

A significant SCA (Supreme Court of Appeal) judgment last year provides an excellent example of just such a case.

Neighbours at war in an upmarket suburb

The scene here is Kloof Road in Cape Town’s Bantry Bay, renowned for its prime location on the Atlantic Seaboard, luxurious houses, and panoramic sea views.

The protagonists are next-door neighbours, whose acrimonious relationship and long history of disputes was founded in the one owner’s renovations, and the other’s strenuous objections to them. Who will eventually win that particular battle remains for another court to determine, but in the course of these disputes the one owner, a senior attorney, accessed his neighbour’s confidential credit records using a colleague’s login details.

This tactic backfired when the neighbour laid criminal charges against her adversary, saying that he had unlawfully and covertly accessed her personal and private information without the required authority or consent. She later added charges of fraud and defeating or obstructing the administration of justice, alleging that during the consequent investigation he had variously and falsely claimed firstly to have not accessed her data, then to have had her consent, then to have acted as her attorney, and lastly to have accessed her records inadvertently.

The media’s reporting of this high-profile spat created what the Court later described as a “public spectacle”, and the trial courts will have to wade through a web of hotly-contested and conflicting evidence in their search for the truth.

But for now, our interest lies in the fact that the NPA declined to prosecute on any of these charges. Undeterred, the neighbour initiated a private prosecution, a move hotly contested by her opponent all the way up to the SCA.

What must you prove to launch a private prosecution?

The SCA, in ultimately allowing the neighbour to proceed, set out our law on the matter.

The starting point is always the NPA issuing a certificate nolle prosequi (a fancy Latin term meaning simply that the State declines to prosecute), for it is that certificate which opens the door to you to have a go at it yourself. As a side note here, legislation specific to the SPCA, SARS and a few other specialised entities allows them to prosecute specified matters without a nolle prosequi certificate – but the rest of us need one.

Once you’ve got your nolle prosequi certificate you must prove that:

- You have an interest in the issue of the trial.

- Your interest is substantial and peculiar to you.

- Your interest arises from some injury individually suffered by you.

- Your injury was suffered as a consequence of the commission of the alleged offence.

In deciding whether or not to grant your application, the court will also consider whether private prosecution would offend public policy. If you are shown to be acting maliciously, vindictively, vexatiously, or without foundation, your application will fail.

Essentially, the Court performs a balancing act between your right to have your dispute “resolved by application of the law and decided in a fair public hearing before a court”, and the accused person’s “right not to be subjected to unfounded and vexatious private prosecution.”

In this case, the Court allowed the private prosecution to continue, commenting that the accused would now have the opportunity to vindicate his innocence at trial.

Think before you leap

Before you charge blithely down this route, bear in mind that private prosecution carries, in the Court’s words, “enormous financial risk”. So be very confident of your prospects of success and bear in mind that:

- Even if you win it’s a costly exercise, because you are now paying your own legal team and a private prosecutor out of your own pocket rather than relying on state officials to do the job for you.

- If you lose and the trial court finds your prosecution to be unfounded and vexatious (a real risk after the NPA declined to proceed), you risk punitive costs and compensatory orders. If the accused can prove you acted without reasonable cause and with malice, you could also be liable for damages in a separate civil claim for malicious prosecution.

Considering a private prosecution? We’ll help you weigh up the pros and cons.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews